Scripted Supply: A Bitcoin-Based Architecture for EDI and On-Chain Commerce

EEI—Electronic Exchange Instructions

Chapter 1: The Problem with EDI and Commerce Today

A Brief History of EDI and Its Evolution

Electronic Data Interchange (EDI), in its canonical form, is the vestigial scaffolding of 20th-century mechanised trade. It represents the fossilised strata of an era in which computation was emergent and decentralised consistency was infeasible. It is often mistaken for a protocol. This is a categorical error. EDI is not a protocol in the formal sense of computability or communication theory. It is an encoding convention, an artefact of standardisation without enforcement—semantics without semantics, structure without determinism, interpretation without validation. It encodes the surface form of intention but not its binding. In computability terms, EDI constitutes a class of languages that are parsed by deterministic finite automata (DFA), but whose interpretation lies outside the model—delegated entirely to human institutions and extra-protocol conventions.

The genesis of EDI lies not in abstraction, but in mechanical necessity. In the late 1960s and early 1970s, commercial entities such as transportation carriers (notably Southern Railway in the US) and automotive manufacturers (notably Ford and General Motors) began to digitise the interchange of commercial forms—purchase orders, invoices, shipping manifests—not by encoding business logic, but by agreeing on fixed record formats. The earliest systems employed fixed-width fields and delimiter-based ASCII templates, operating on the assumption that if sender and receiver agreed on the number of characters per line, then some mutual understanding could be achieved. This principle—syntax as a stand-in for state—persisted as EDI matured.

Two principal standard families dominate the global EDI landscape: ANSI X12 (in North America) and UN/EDIFACT (internationally, under UN auspices). These standards define transaction sets, which are essentially deterministic schema definitions over structured strings. A typical X12 850 purchase order message comprises nested segments (e.g., BEG, REF, N1, PO1) and elements (e.g., product identifiers, quantities, pricing terms) within each segment. These are strictly ordered and bounded by maximal character lengths, yielding a language easily parsed by DFA but not intrinsically meaningful to any executing machine. Parsing is possible. Semantics are not.

Critically, the semantics of EDI are not validated by the machine. That is, a correct EDI message may encode a lie—a document asserting a shipment occurred, payment was made, or goods exist. The protocol does not and cannot prevent this. It contains no enforcement layer. It is this disjunction—between syntactic correctness and semantic truth—that underlies the epistemic instability of all modern commerce built upon EDI.

To demonstrate this formally: let

be the set of all syntactically well-formed X12 850 purchase order messages.

is regular; a DFA exists that accepts all and only such strings. Let

be the subset of messages that correspond to truthful, executed commercial events. There is no algorithm—deterministic or otherwise—within the confines of EDI that can decide membership in T. The mapping from message to reality is extra-formal; it depends on external state, human verification, and exogenous systems (such as delivery scans, payment systems, and legal recourse). This implies that EDI cannot resolve the semantic gap between intent and execution.

As VANs (Value Added Networks) emerged in the 1980s, they became centralised intermediaries responsible for routing and temporarily storing these EDI messages. But VANs offered no guarantees beyond delivery. They are epistemologically passive. They do not and cannot assert that a message corresponds to any real-world change in goods, services, or money. Their primary function was to emulate the postal system, albeit electronically, and with tracking. What they enabled was faster propagation of unverifiable claims. They did not change the trust assumptions—they ossified them.

The advent of XML and later JSON did not alter the fundamental structure. It merely transposed it into human-readable formats. The shift to so-called “modern” APIs (Application Programming Interfaces) in the late 1990s and 2000s—using HTTP, RESTful endpoints, and OAuth-authenticated JSON payloads—did not solve the core problem. APIs, in this context, are merely dynamic interfaces to proprietary EDI schemas. The same semantic impotence remains. Messages are mutable, trust is externalised, and execution is unverifiable. Indeed, APIs have increased opacity, as proprietary implementations may change message behaviour depending on system version, business rules, or vendor configurations. The epistemological question—Did the thing that was declared actually happen?—remains unanswerable within the system.

This is more than a technical deficiency. It is a systemic economic pathology. EDI assumes and institutionalises epistemic fragmentation: each participant in the supply chain maintains its own copy of reality, reconciled periodically through reports, audits, disputes, and litigation. In formal terms, commercial state is non-singular. Let

be a set of commercial participants. Each participant

maintains a local state

derived from its own ledger and message log. There is no function f such that

without invoking trust, reconciliation, or external dispute mechanisms. The system lacks state convergence.

This is the critical insight: EDI does not fail when it transmits incorrect information. It fails when it successfully transmits well-formed lies. The system is so formally weak that its correctness criteria are entirely syntactic. One cannot prove execution, only encoding.

Thus, we must discard the illusion that EDI ever provided a deterministic commercial protocol. It is not a mechanism of truth, but a mechanism of expression—frozen at the level of syntactic legibility. It relies on trust, institutions, duplicated accounting, and a universe of human oversight. And because of this, it necessarily entails overhead, delay, redundancy, and error.

In the coming sections, we will demonstrate that the correct formulation of a commercial protocol is not one which encodes documents, but one which encodes state transitions. Each transition must be provable, irreversible, and bound to cryptographic identity and time. Each transition must encode a change in the world—not a declaration of intent. A protocol must enforce the act, not describe it. And for that, one does not need XML. One needs a ledger—a machine of state. Bitcoin, with its Script system, provides exactly that. But before we can build this system, we must finish dismantling the legacy it is to replace.

The Centralisation Problem in EDI Infrastructure

At the heart of every legacy EDI system is a contradiction: it is presented as a machine protocol, yet it presupposes the existence of a trusted intermediary. Despite the deterministic formatting of X12 segments or EDIFACT hierarchies, the transmission of data and its receipt is entirely dependent on a central conduit—one that introduces a control surface, a failure point, and most importantly, a single vector for epistemic manipulation. This centralisation—both technical and institutional—is not a side effect. It is the prerequisite for EDI to function at all. The system cannot operate without assumed custody over message flows.

To understand this fully, we must distinguish between message-based systems and state-based systems. A message-based system encodes an instruction or declaration. It says, “I sent an invoice,” “I acknowledge shipment,” or “Here is a purchase order.” A state-based system does not merely encode that a message was sent—it encodes that a fact has occurred. In formal systems theory, a message carries intended meaning, but a state transition carries executional proof. EDI remains irrevocably message-based. Its semantics are only enforceable through external, off-protocol processes.

The conduit for such messages—whether a Value-Added Network (VAN), an API gateway, or a cloud EDI integration provider—holds the functional position of a semi-trusted relay. These intermediaries are responsible for routing messages, logging them for later access, and in some cases applying validation schemas. But the validation is syntactic. It does not and cannot reach into the domain of semantic or executional truth. A VAN will flag a malformed 810 invoice if the segment count is invalid, or if a data field exceeds its character length. It will not—and cannot—detect a fraudulent claim of delivery, or an inflated billing quantity, or a shipment that never occurred. The centrality of the VAN gives it visibility, but not verification power.

Let us make this precise. Assume a VAN V intermediates messages between sender A and receiver B. Let m be a message asserting a commercial fact ϕ (e.g., that goods were shipped). The VAN V can confirm that message m conforms to a format F, i.e.,

V ⊨ m ∈ F

However, V cannot confirm the truth of ϕ; that is,

V ⊭ ϕ

Worse, the recipient B is now in a position of having to either accept or challenge ϕ, but does so on the basis of syntactically valid yet semantically unsubstantiated information. This is not a bug — it is the design.

Moreover, the position of the VAN or intermediary API provider introduces asymmetry into commercial systems. Whoever controls the message relay infrastructure has the ability to:

Delay or reorder messages

Omit or suppress messages

Modify message payloads prior to storage or re-transmission

Create audit trails that reflect events that did not occur, or obscure those that did

These are not hypothetical. Real-world supply chains routinely suffer from disputes involving message non-delivery, re-routing through faulty VAN configurations, and API-level race conditions that overwrite or invalidate previously submitted records. No cryptographic guarantees exist at the EDI protocol level. Message mutability is intrinsic. There is no hash-based immutability, no proof-of-inclusion, no timestamping resistant to rollback. The VAN acts as both source and sink of commercial truth, and truth becomes negotiable.

Additionally, centralisation introduces fragility in systemic availability. If the VAN goes offline, no messages are processed. If the API authentication token is revoked—due to expiry, error, or malice—the sender becomes epistemologically silent, regardless of what events are happening in the real world. Worse still, many commercial entities outsource the management of their EDI pipelines to third-party integrators who build custom logic on top of EDI wrappers. These black-box systems collapse transparency and further distance the commercial actor from the structure and semantics of their own messages.

To tie this to formal systems theory: in a centralised EDI infrastructure, the protocol is not closed under composition. While individual messages may be formatted correctly, the system as a whole cannot be composed into a provable state machine.

To tie this to formal systems theory: in a centralised EDI infrastructure, the protocol is not closed under composition. While individual messages may be formatted correctly, the system as a whole cannot be composed into a provable state machine.

Let

M = m₁, m₂, …, mₖ

be a sequence of valid messages (e.g., 850, 940, 810). There exists no deterministic transition function

δ

such that:

σₖ₊₁ = δ(σₖ, mₖ)

where

σₖ is a well-defined commercial state at step k, and

σₖ₊₁ is its intended successor.

In other words, there is no formalism by which the reception and syntactic validation of an EDI message leads to an enforced, convergent commercial outcome. The protocol lacks referential transparency — the property that the output of a function is determined solely by its inputs, without side effects or hidden context.

This is a fundamental limitation that cannot be patched by adding more APIs or integrating more cloud systems. As long as state is reconstructed from messages, and those messages are mutable, unverifiable, and interpreted by external systems, the system will always be vulnerable to:

Epistemic divergence between actors

Disputes that require institutional arbitration

Exploits based on timing, message duplication, or race conditions

Irrecoverable errors due to corrupted state that cannot be rolled back or proven

This centralisation is not merely architectural. It is economic. Intermediaries are not neutral. They monetise position. VANs charge for throughput. API providers charge per request. EDI cloud platforms charge for integration and lock-in. All of them benefit from the friction they allege to reduce. They have no incentive to make state machine transitions deterministic, because their profit model depends on interpretive opacity and the associated need for human dispute resolution, managed services, and institutional enforcement mechanisms.

In the paradigm we are constructing, these problems are not mitigated—they are obliterated. The replacement for EDI is not a better message bus. It is the complete inversion of the model: from message-based to state-based, from centralised to cryptographically enforced, from mutable logs to immutable transitions, from third-party adjudication to machine-enforced commercial fact.

What this requires is not new networking infrastructure. It requires a ledger. Not a ledger in the superficial sense of a database, but in the rigorous sense of an immutable, cryptographically-verifiable, time-ordered structure of state transitions—where each state is both public and self-enforcing. Each transaction must not declare what is believed to have occurred, but must cause it to occur, unambiguously and irreversibly. And for that, only one model exists: a distributed, permissionless ledger governed by an execution language constrained to determinism. This is what Bitcoin, and only Bitcoin Script in its original form, makes possible.

But before we arrive at construction, we must continue excavation. The pathology runs deeper. In the following sections, we will turn our attention to the false promise of API modernisation and the structural decoupling of money from messages—a flaw that EDI will never solve, but Script will never allow.

Why Cloud APIs Are Not a Solution

The modernisation of legacy EDI infrastructures via RESTful APIs, JSON schemas, and cloud-native services is not a transformation of paradigm, but a superficial restructuring of syntax. The illusion is semantic progression; the reality is a more fragile, mutable, and centralised system—merely faster in propagation and more obscured in architecture. The transition from fixed-width ANSI X12 or EDIFACT segments to JSON payloads wrapped in HTTPS endpoints represents an aesthetic improvement, not a semantic one. It does not solve the fundamental computational problem: the absence of binding between declaration and execution.

Cloud APIs do not create state. They return strings. At best, they represent stateless, parameterised function calls over a mutably defined internal model. A call to POST /invoices does not encode the creation of a commercial fact. It triggers a code path that inserts a row into a private database, subject to permission logic, internal validations, and business rule abstractions—all of which are opaque, mutable, and entirely under the control of the API provider. The truth of the invoice—that it exists, that it was sent, that it represents a claim upon a counterparty—is not verifiable outside of the system. In no meaningful sense is it cryptographically proven or externally composable.

Consider the semantic structure of an API transaction:

POST /invoice { "invoice_id": "12345", "amount": "10000", "currency": "USD", "recipient_id": "XYZ_CORP", "due_date": "2025-07-01" }This message is not deterministic in outcome. Its processing depends on mutable logic—stored procedures, cloud function triggers, application state, and authentication context. There is no guarantee that the same payload submitted tomorrow will produce the same effect. Even if the endpoint is idempotent, the invocation is not provable. There is no proof that it happened. There is no proof of what the internal logic returned. There is no commitment to a global, immutable state. In computability terms, the system is not referentially transparent: calling the same function with the same parameters may yield different side effects depending on system state and temporal context.

To formalise the contrast, let f : M → S be the API’s internal mapping from a message m ∈ M to a state transition s ∈ S.

In legacy EDI and modern API systems, f is undocumented, mutable, and non-verifiable. There exists no external observer that can assert the existence or correctness of f, nor its immutability.

In Bitcoin, by contrast, state transitions are defined as T : σₖ → σₖ₊₁ where σₖ₊₁ is provably derived from σₖ via transaction t, and t is globally published and irreversibly mined into a chain with economic cost.

No such enforcement mechanism exists in cloud APIs.

Furthermore, APIs imply a delegation of truth. The client sends a message. The server responds with a success code—200 OK. The assumption is that the action requested has been completed. But this is merely a trust statement. The server could be compromised. The logic could be flawed. The request could be accepted and then rolled back. The API could respond falsely to preserve business logic continuity. There is no signature. No merkle root. No state commitment.

This is not conjecture. Every API-based SaaS product today allows retroactive modification of state. Invoices can be deleted. Purchase orders edited. Fulfilment logs overwritten. Nothing is cryptographically enforced. Even with “audit logs,” these are mutable constructs—append-only in interface, not in enforcement. They exist at the mercy of administrators and cloud operators.

Additionally, these systems instantiate centralised legal risk. The API provider is often a counterparty to the message itself. Shopify, Oracle Netsuite, SAP Ariba—these platforms not only host but authoritatively interpret the meaning of the messages sent. This means they hold the dual role of ledger maintainer and ledger editor. They are not neutral parties. They are liable to policy shifts, downtime, platform sunsets, feature deprecation, and financial prioritisation of larger clients.

From the perspective of distributed systems, the model violates every constraint of Byzantine fault-tolerant design. There is a single point of failure, a single point of trust, and a single point of authority. From the perspective of programming language theory, the model fails to meet functional purity: side effects dominate, and there is no mathematical mapping from input to output.

Let us formalise this. Suppose P(x) is a payment initiation function over message x, and Q(y) is a delivery confirmation predicate over response y. In current API ecosystems, there exists no proof that P(x) occurred other than the system’s internal logs. There exists no proof that Q(y) corresponds to a legitimate delivery confirmation. There is no canonical external function H such that:

In contrast, in a Bitcoin-based transactional model, x is a transaction script, y is a mined output, and Q(y) is verifiable by all nodes globally. P(x) cannot lie because its execution is its truth. The entire logic is executed under a common, deterministic virtual machine, and no party can arbitrarily mutate H. Bitcoin’s H is the proof-of-work enforced ledger history.

Therefore, the introduction of cloud APIs into EDI pipelines does not mitigate trust—it concentrates it. It increases speed while decreasing transparency. It amplifies throughput while collapsing auditability. It creates velocity without verification. It is a system of messages, not state. Of mutable declarations, not enforced facts.

This is not a modernisation. It is a trapdoor. And like all trapdoors in computation, it creates undecidable systems masquerading as deterministic ones. In this environment, no truth exists outside the platform operator’s logs. And if truth is negotiable, then commerce is not programmable. It is litigated.

The goal of EDI was to mechanise commerce. The result was mechanised ambiguity. The goal of cloud APIs was to accelerate trade. The result was accelerated opacity. If we seek a system of commercial certainty—of state, not supposition—we must exit the architecture entirely. APIs are not the road to trustlessness. They are its last, fragile remnant before collapse.

In the next section, we will expose the most severe failure of all: the total disconnection between message and payment. The problem is not simply semantic. It is ontological. Commerce without atomic payment is not commerce—it is correspondence.

Payments and Settlement Remain Detached

No matter how refined the schema, how compliant the message formatting, or how rapid the delivery of a purchase order or invoice, the Electronic Data Interchange system—both in its legacy and modernised forms—fails where it matters most: at the point of payment. The crucial act of commercial finality, the discharge of obligation through transfer of value, exists entirely outside the EDI protocol. There is no binding between message and money. There is no cryptographic, atomic link between invoice and remittance, between delivery and settlement. EDI describes transactions. It does not execute them. It cannot.

Let us formalise the gap. Let m be an EDI message representing a commercial intention (e.g. an 850 purchase order or an 810 invoice). Let p be a payment operation in a separate financial network (e.g. SWIFT, SEPA, ACH, FPS, or VisaNet). There exists no function f: m ↦ p such that f is injective, verifiable, and immutable. In practice, the linkage between m and p is implemented by external metadata: invoice numbers in bank remittance fields, references typed by accounts payable staff, or matching line items in monthly reconciliation spreadsheets. These are not bindings. They are conventions. They are hopeful correlations, not guaranteed constructions.

From a systems architecture perspective, this represents asynchronous, non-atomic protocol bifurcation. Two systems—one for messaging (EDI, ERP, email, API) and one for value transfer (banking, card, crypto)—run in parallel, without enforced consistency.

Let ℳ denote the message domain and ℙ the payment domain. Then for any m ∈ ℳ, there is no guarantee that a corresponding p ∈ ℙ exists, nor that such correspondence can be proven within ℳ. The two domains are not commensurable.

This is a systemic failure, not merely a technical inconvenience. It creates the need for entire industries: invoice factoring, dispute resolution, auditing, chargeback management, legal enforcement, and regulatory compliance. All exist to address the fact that the commercial world cannot prove that payment corresponded to agreement, or that goods matched remittance, or that intention was followed by execution. This is not redundancy. It is parasitism on a defective substrate.

Consider a simple transaction. A supplier issues an invoice for $10,000, payable in 30 days. The invoice is transmitted via EDI as a formatted message. The customer, using separate systems, remits payment via bank wire, noting the invoice number in a reference field. There is no machine-verifiable binding between the invoice message and the value transfer. The systems can diverge. The payment may be delayed, short-paid, misrouted, or posted to the wrong account. The only recourse is human reconciliation and institutional trust.

In Bitcoin, this gap does not exist. The transaction is the payment. The output is the settlement. The script is the agreement. The block is the proof. In other words, the act of committing data to the ledger is the transfer of value. Let t be a Bitcoin transaction and s a locking script representing commercial terms. Then t commits to s and transfers value under those conditions. There is no need for a second system. The transaction itself encodes the truth of the act.

Moreover, Bitcoin enables atomicity. The value and the condition are bound. One cannot occur without the other. The payment is conditional on script satisfaction, and the script execution is conditional on payment being included in the transaction. Formally, let t = (v, s) be a tuple of value v and script s. Then the transaction is valid if and only if s executes successfully and transfers v under the consensus rules. This is a symmetry EDI can never achieve.

The implication is severe: EDI does not mechanise commerce. It mechanises correspondence about commerce. Payment, the sine qua non of transaction finality, is wholly outside its domain. And where payment is not embedded, fraud is always possible. Delay is always possible. Reversal, misrepresentation, denial—these are not edge cases. They are systemic characteristics of all architectures in which payment and promise are not co-located in a single, verifiable state transition.

It is not enough to improve payment APIs. To close the gap, commerce must be implemented as atomic transitions: one state to another, through a deterministic protocol, with value movement and condition enforcement encoded in the same construct. This is what Bitcoin transactions are, and what no other commercial system provides.

Until payment and message are one, commerce remains unverifiable. Until execution and declaration are fused, automation is theatre. EDI without atomicity is performance, not proof. Bitcoin ends that performance. It replaces it with computation.

Failure Modes in Traditional Commercial Systems

One of the most significant flaws in legacy EDI and order management systems lies not in their interfaces, nor in their messaging latency, but in the structural ambiguity that arises from asynchronous processes with mutable, loosely coupled records. The following detailed analysis is prompted by a user-submitted failure case (reproduced visually above) which reveals a class of faults stemming from the decoupling of order state from verifiable logic. These scenarios, far from being fringe, represent systemic vulnerabilities inherent to the "old system" model. Here, we provide a categorical breakdown.

I. Receipt Without Reconciliation — Double Fulfilment Through Document Drift

In the example presented, a customer places an order. The order is processed and an invoice is issued. Before fulfilment is complete, the customer requests an amendment. The office cancels the invoice, but fails to cancel or recall the fulfilment instructions. The warehouse picks and stages the original order. Then, the amended order is processed and picked again. No system detects the duplication. Both packages are staged. The customer collects both, pays only for one, and the company incurs a silent loss.

Root causes:

Cancellation event not atomically linked to fulfilment state

Physical goods prepared based on stale logical instructions

Lack of traceable audit at the staging interface

Duplicate authorisations without cross-check against amended state

II. State Fragmentation — When Documents Disagree and No Component Knows All

Traditional systems separate logical components: ordering, invoicing, warehousing, collection. Each is driven by mutable representations of the order: form IDs, timestamps, notes. The system presumes coordination, but no shared truth exists. The warehouse does not verify against the live billing system. The office cancels the invoice, but that act exists only in one subsystem. The result: a de-synchronised set of beliefs about what the order “is”.

Failure vector:

Logical view of order not cryptographically linked across all subsystems

Multiple valid but non-identical “versions” of the same order

Authority to fulfil persists without authoritative linkage to billing

III. Physical Theft by Protocol Design — Unintentional Overdelivery

In the failure scenario, the customer collects both orders — one intended, one erroneously reissued — and no one challenges this. This is not theft in the legal sense, but loss through protocol misalignment. The system permits overdelivery by design because it has no way to bind pickup to a singular, validated delivery event. There is no enforcement of one-for-one mapping between invoice settlement and physical release.

Contrast with BSV approach:

In Bitcoin, a transaction to release goods can be cryptographically bound to a single claim

Each pickup requires proof of settlement or fulfilment via script conditions

Redundant claims can be made, but only one can be executed on-chain, enforced by UTXO uniquenessIV. Hidden Losses and Delayed Discovery — Stock Drift Detected Only Post Facto

The final consequence is subtle but devastating: the business doesn’t notice the error until a physical stocktake or a manual audit uncovers the discrepancy. This is due to the non-finality of state transitions. There is no “closing event” that says this stock has left and was paid for. Instead, there are fragments: a picked order, a cancelled invoice, a missing audit, and a customer long gone.

Systemic issue:

No single, irreducible record binding payment and delivery

Logging happens in documents, not proofs

Reconciliation is post hoc, not preventative

Losses are not discovered when they occur, but when the gap is noticed

V. Generalising the Failure Class — Asynchronous Invalidated Authorisations

The failure case exemplifies a broader category: authorisation drift. An event occurs (invoice cancellation) which should invalidate a previous authorisation (warehouse pick). But the system lacks the atomicity or binding condition to enforce this. The result is that old authorisations remain "live", even after they should be void.

Correct model:

Authorisation is a state function of prior events

Cancellation must revoke fulfilment not by instruction, but by contractual invalidation

State machines must evaluate spending conditions at the point of execution, not at point of issue

VI. BSV Remedy: Cryptographic State Binding with Forward-Only Logic

In BSV, this class of error is structurally impossible when systems are designed correctly. Every UTXO (unspent transaction output) is:

Singular: it can be spent only once

Conditional: it defines the full script for spendability

Deterministic: its spend is validated before acceptance

Immutable: once conditions are set, they cannot be reversed

A warehouse-issued delivery token can be modelled as a UTXO requiring:

Proof of payment (signature + preimage)

Time window (optional)

Destination confirmation (multi-party signing or hash-locked precommitment)

Once a delivery token is claimed, it is spent. The physical act of pickup is linked to this claim. Any other previously staged tokens — even if they physically exist — are logically inert unless validated. Thus, even if two packages are prepared, only one can be collected through valid proof. The other, if claimed, fails consensus validation. No system will recognise the second pickup as legitimate.

VII. Conclusion: Designing for Irreversibility Prevents Ambiguity

This failure scenario, while specific, exemplifies a design pattern: systems that treat process steps as mutable messages invite ambiguity. But when each step is a verifiable commitment, state is preserved without contradiction. The role of BSV is not to send instructions. It is to encode proofs of fact. No action is permitted unless its conditions are proven. And no proof can be re-used.

The lesson: avoid state drift by making every action a scriptually bound transition. Model your supply chain as a sequence of spendable rights, not a set of mutable instructions. And ensure that once something is cancelled, it becomes — cryptographically and finally — unspendable. That is how Bitcoin prevents fraud, even in the most mundane corner of the warehouse floor.

The Problem of Redundancy and Verification

The structural flaw of all EDI systems—legacy, API-based, or hybrid—is that each participant maintains their own copy of truth. Not merely their own record, but their own interpretation of what is true. This results in a condition of epistemic fragmentation, where no single source of state is authoritative, and every assertion must be independently verified, reconciled, or disputed. It is not simply that truth is decentralised. It is that truth is duplicated, divergent, and ultimately unverifiable without costly human coordination.

Formally, let

represent a set of commercial entities participating in a supply chain or transaction network. Each participant pip_ipi maintains a local state σi\sigma_iσi, comprising documents, messages, and ledger entries that reflect their belief about current commercial conditions—inventory, payment status, delivery confirmation, and so on. These local states are constructed from received EDI messages, internal data entry, and manual adjustments. The problem is: for any pair (σi,σj)(\sigma_i, \sigma_j)(σi,σj), there is no guarantee of consistency. There is no canonical mapping or consensus function

that yields a unified global state. Hence, the system is non-convergent.

This non-convergence introduces three endemic classes of failure:

Redundancy of storage and computation: Every party stores every document and every transaction. Purchase orders, invoices, advance shipping notices (ASNs), and remittance advices are duplicated across dozens of systems. Let d∈Dbe a document shared between k parties. Then system-wide storage is at least O(k). This is not merely inefficient—it increases the probability of inconsistency. Data rot, version mismatch, partial updates, and time-dependent interpretations all emerge from the act of redundant storage.

Ambiguity of verification: The existence of a message does not prove its correctness. For example, receiving an 810 invoice does not confirm that the goods were received or that the price is correct. Verification is externalised to human processes—phone calls, email chains, quarterly audits. No script enforces semantic truth. All verification is retrospective.

Delays from consensus simulation: Because there is no shared ledger, commercial actors simulate agreement through reconciliation cycles. These cycles—weekly, monthly, quarterly—attempt to converge divergent local states through labour. The cost is latency, dispute resolution, and financial misallocation. This is a simulation of consensus, not actual consensus.

Let us illustrate this with a simple example: A purchase order is sent by Company A to Company B. Company B ships the goods, generates an invoice, and posts the expected delivery. Company A logs the expected delivery, updates internal inventory projections, and schedules payment. But the goods are delayed. Or misdelivered. Or underdelivered. Or invoiced incorrectly. Or marked as delivered erroneously. Every system now diverges. Each believes something different about the state of the transaction. And there is no machine-verifiable way to determine who is correct.

In such a system, truth is negotiated, not computed. The participants engage in interpretive reconciliation. Internal records are corrected. Adjustments are made. Exceptions are logged. The result is a system in which the most authoritative truth is the one with the best paper trail, not the best logic.

Contrast this with a model where each commercial event is a state transition encoded in an immutable ledger, and each state change is provable by all parties. Let

be the current state, and let ttt be a transaction such that

. In Bitcoin, each ttt is globally broadcast, irreversibly committed, and cryptographically linked to the prior state. No duplication exists. No reconciliation is required. The ledger itself is the authoritative source. Verification is not interpretive—it is algorithmic. It is computation, not conversation.

This eradicates redundancy. There is no need for parallel databases. No need for matching documents. No need for reconciliation meetings. The output of each valid transaction is the input for the next. Every state is derived, not declared.

More precisely: If a party claims a commercial fact ϕ, they must commit to a transaction ttt such that t⊢ϕ and t is publicly visible and mined into a shared ledger. This construct ensures that all claimed facts are not just asserted—they are executed.

Legacy systems lack this. They rely on coordination, and every act of coordination implies both cost and failure risk. In computational terms, they simulate distributed consensus through asynchronous message passing with no Byzantine guarantees and no shared clock. In Bitcoin, consensus is embedded in the protocol: nodes verify, miners enforce, and economic incentives secure the state. This is not simulated reconciliation. It is native finality.

The legacy model breeds redundancy. Bitcoin Script annihilates it. The former distributes data and asks for trust. The latter distributes truth and asks only for computation. Until commerce adopts a model in which all participants compute over the same canonical state, it will remain fragmented, redundant, and vulnerable to falsification masquerading as formality.

Case Study: Shipment Verification Failure

To understand the structural fragility of EDI in practice, one need not speculate. A concrete example—drawn from the lived and routine failures of global logistics—illustrates how an apparently well-functioning EDI pipeline can produce cascading epistemic breakdown. The failure is not one of communication delay or technical malfunction, but of architectural insufficiency: the system cannot represent truth, only messages. These messages may be well-formed, timely, even authenticated. But they are not binding. They do not enforce action. And because they cannot verify execution, they offer no guarantee that what was declared actually happened.

Let us examine a standard multi-stage trade event between two entities: AlphaCorp (buyer) and BetaLogistics (supplier and shipper). Assume both firms are EDI-compliant, ISO-certified, and utilise integrated ERP systems. The following event chain unfolds:

Purchase Order Generation:

AlphaCorpissues a purchase order (PO), encoded as an ANSI X12850message. This message contains line items, quantities, delivery instructions, and terms. The message is valid, timestamped, transmitted via VAN, and logged in both parties’ systems. At this point, a commercial intention is created, but no state change is yet enforced.Acknowledgement:

BetaLogisticsreplies with an855Purchase Order Acknowledgement. The message is parsed, validated, and filed. At this point, both systems record agreement on what is to be shipped. Still, no goods have moved, and no value has transferred.Shipment Creation: Upon internal warehouse picking,

BetaLogisticsgenerates an856Advance Shipping Notice (ASN), which is transmitted toAlphaCorpand accepted without error. The ASN includes serialised packaging, estimated arrival, carrier metadata, and product identifiers. Crucially, the ASN claims that the items have been physically dispatched.Goods in Transit: The shipment is delayed due to rerouting and arrives three days late. During transit, no real-time tracking is integrated into the EDI messages. The system continues to assert that delivery is "pending" on the scheduled date. No update is pushed unless manually triggered.

Goods Receipt: At the receiving dock,

AlphaCorpdiscovers that 2 of the 10 pallets are damaged and 1 is missing. However, the receiving system is unable to reject the ASN. Instead, warehouse personnel generate a manual exception report and attach it as a940Warehouse Shipping Order Exception—outside the EDI loop. The core EDI system is unaware of the discrepancy.Invoice Issuance: Meanwhile,

BetaLogisticsgenerates an810Invoice for the full order. The invoice is auto-posted intoAlphaCorp’s accounts payable system based on ASN matching, not physical inspection. Payment is scheduled within seven days.Payment Release: The payment is released via a separate financial system with no linkage to EDI except an invoice number typed in a bank reference field. The value transfers. No script, message, or program enforced that the delivery matched the invoice or that the goods were intact.

Dispute: Upon quarterly audit, the discrepancy is discovered.

AlphaCorpinitiates a chargeback request, citing invoice overpayment.BetaLogisticsdisputes the claim, citing ASN match and confirmed invoice acceptance. The process enters litigation.

From a systems perspective, the problem is this: every step succeeded—in the sense that every EDI message was parsed correctly, transmitted successfully, and logged faithfully. But the system cannot prove anything. It cannot prove that the goods were shipped, only that a message claimed they were. It cannot prove that delivery occurred, only that it was scheduled. It cannot prove that the payment was for delivered goods, only that the amount matched an invoice tied to a message, not an outcome.

Formally, let:

m_{ship}be the ASN message stating shipment occurred,m_{invoice}be the invoice message asserting payment is due,pbe the payment transaction executed outside the protocol.

There exists no function f such that:

where ϕ asserts "payment corresponds to received goods under agreed conditions." No such f exists because the elements are non-binding. The payment is not conditional on receipt. The invoice is not conditional on delivery verification. The shipment message is not cryptographically committed to the actual delivery contents.

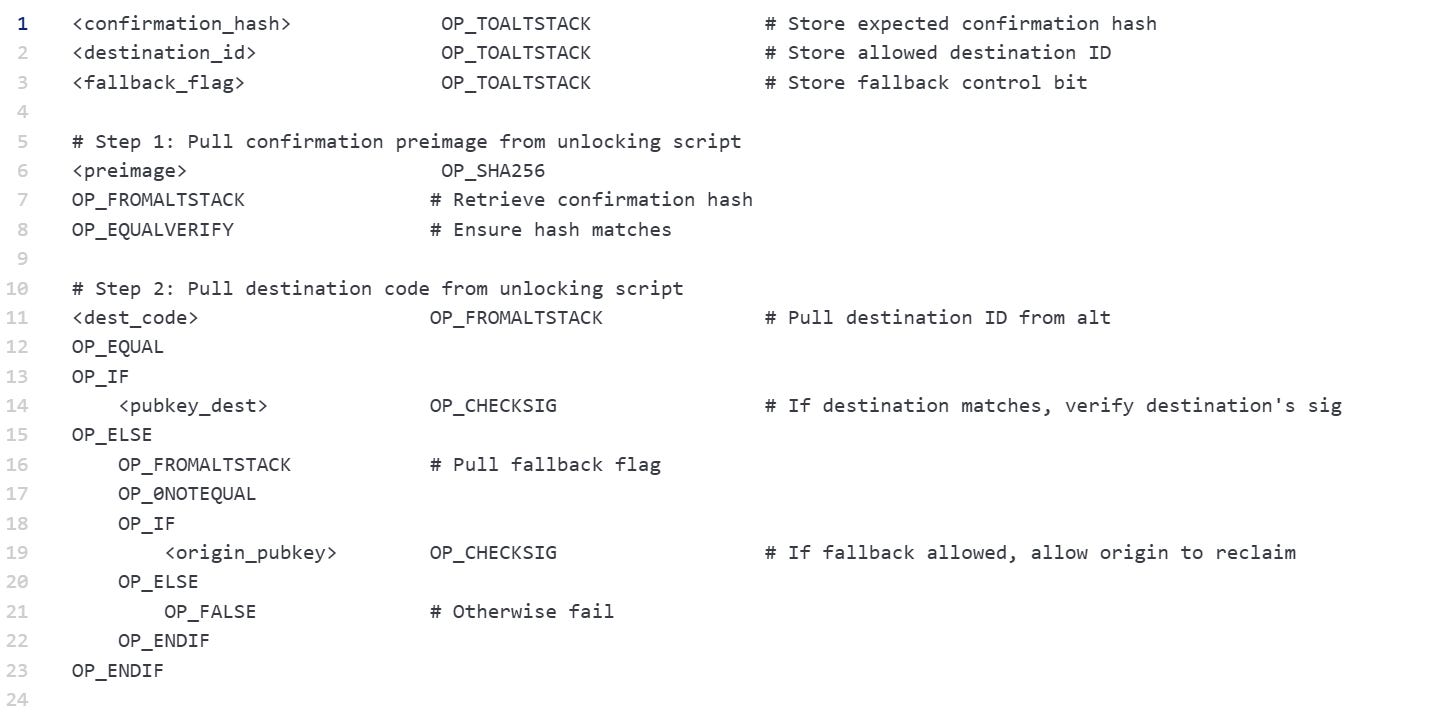

Had the transaction occurred on-chain using Bitcoin Script, each condition could have been enforced:

Shipment assertion encoded in a script requiring a delivery proof signature from

AlphaCorp.Invoice enforced as a script with output spendable only after delivery confirmation.

Payment encoded as a transaction with a conditional

OP_CHECKSIGVERIFYfrom the recipient, preceded byOP_IFthat branches based on delivery hash match.

In such a system, partial deliveries could result in partial payments, and any deviation would result in funds being unspendable, or rerouted to an escrow or dispute branch. The discrepancy would be visible not in audit, but at the moment of transaction execution.

The EDI system succeeded in message handling. It failed in commerce. Because EDI cannot express execution. It can only express expectation. And expectation, no matter how well-formatted, is not truth. Only execution is. Only state is. Only commitment is. Bitcoin encodes commitment.

EDI encodes hope.

Binding Physical and Logical Infrastructure via Blockchain-State Anchoring

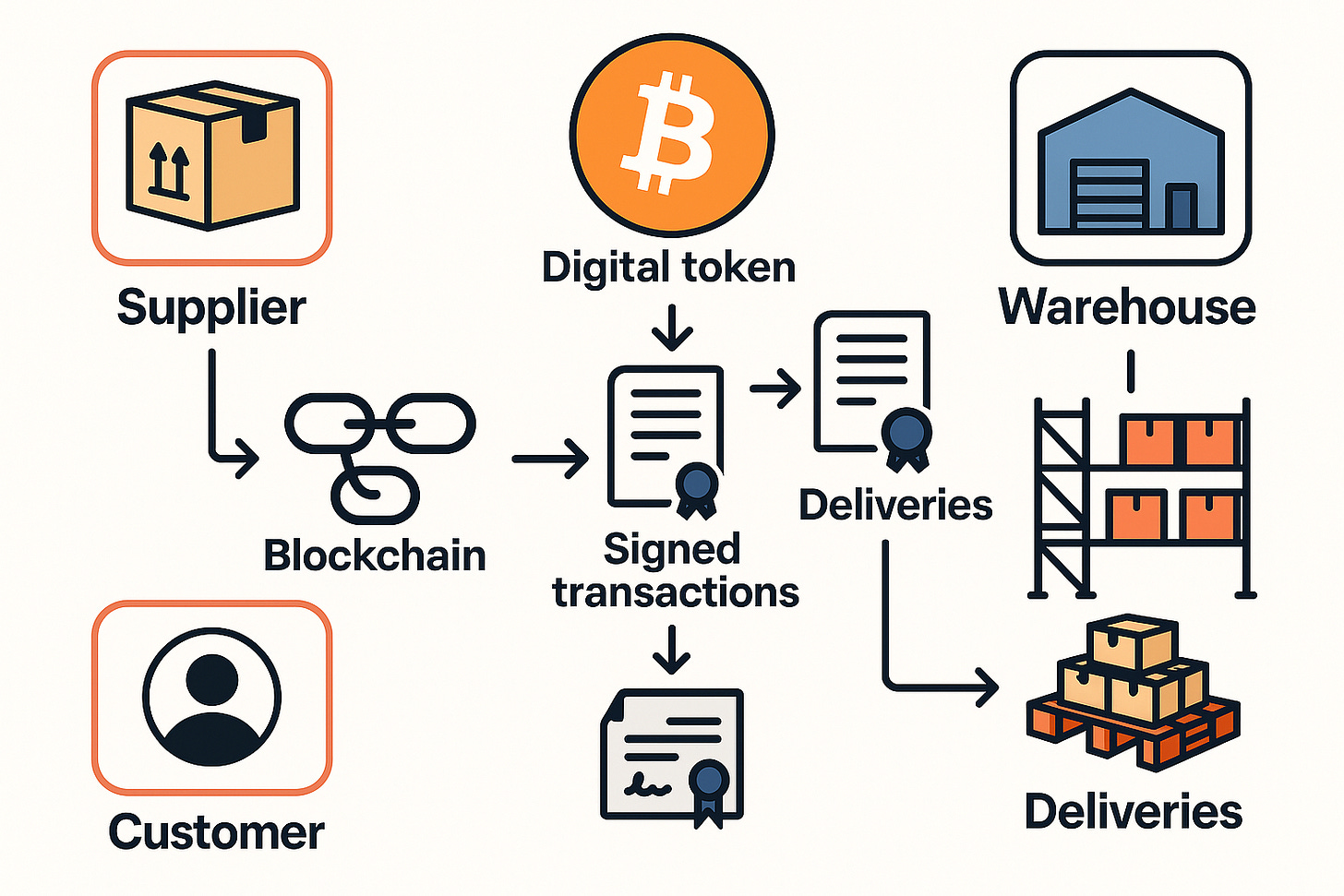

To transition from a legacy, failure-prone commercial logistics system into a deterministic, verifiable, and error-resistant architecture, the introduction of blockchain-backed state anchoring must not only cover the economic logic of transactions but also integrate the communication pathways and physical execution environments — specifically, the warehouse systems, ordering terminals, and client-side interfaces. This section presents a structured model for IP-to-IP communication, event-driven record binding, and transactional anchoring on-chain using BSV as the immutable, cryptographic substrate.

I. Architectural Foundation: Peer-to-Peer (IP-to-IP) Communication and Event Generation

In traditional EDI or ERP systems, inter-party communication is routed through centralised messaging queues, APIs, or polling schedulers. These systems are brittle: state inconsistencies emerge when one party updates records independently or fails to propagate a change to all participants.

In contrast, a peer-to-peer (IP-to-IP) topology enables direct, authenticated transmission of messages — order requests, confirmations, delivery tokens, etc. — between parties, using encrypted channels with time-bounded session keys. This can be secured via ECDH (Elliptic Curve Diffie-Hellman) key exchange, where the public identity of each node is verifiably known, and session-level privacy is enforced.

Each communication event generates:

A local state change (e.g., order status updated to “pending amendment”)

A cryptographic transactional anchor: a hash or signature that proves that the message was received, acknowledged, or declined

This event can be recorded on-chain, not as a blob of data via OP_RETURN (which is discouraged), but through hash commitments inside output scripts, structured to trigger conditional UTXOs only when a valid message has been proven by its recipient.

II. Warehouse and Office Logic as Script-Validated Execution Endpoints

Each subsystem (office, warehouse, collection point) can be abstracted as a state agent, with discrete authority to initiate, amend, or confirm transitions. Their authority is modelled through private keys and role-specific script templates.

For example:

The office system generates an invoice and outputs a UTXO encoding:

OP_CHECKSIGof the office’s private keyA hash lock to the payment confirmation

A redeem condition linked to the expected collection date

The warehouse node receives an event (via IP message), matches it to the UTXO, and prepares physical release conditional on

Valid spend proof of the above output

Cryptographic presence of the customer’s authorised preimage or signature

Thus, the state flow is:

Order placed → Transaction

T₀created (invoice UTXO generated)Office amends order → New transaction

T₁cancels original via script rejection (via hash condition, timeout, or override UTXO spend)Warehouse verifies the state of

T₀before releasing stock — ifT₀’s UTXO is unspent, the order is still valid; otherwise, notCustomer arrives → presents signed transaction

T₂, spends delivery UTXO, becomes the only authorised collector

III. State Anchoring via Transaction Graphs and Deterministic Timelines

Every stage of this process is independently verifiable through the transaction DAG (Directed Acyclic Graph), where each node (transaction) includes:

The full logical script of its constraints

Time-locked conditions where applicable (e.g., nLocktime and the equivalent to

CHECKLOCKTIMEVERIFY)Multisig enforcement for approvals, if required (e.g., office + warehouse joint authorisation)

Critically, every subsystem does not need to consult a central state. Instead, each party reads the blockchain, checks whether the expected prior condition has been cryptographically satisfied (i.e., a transaction has spent the correct UTXO), and acts accordingly.

No ambiguity exists. Either the correct transaction was mined (i.e., the amended invoice took effect), or it wasn’t. Either the collection token was claimed, or it remains locked. State is not synchronised by instruction—it is synchronised by immutable transition.

IV. Application: Resolving the Double-Pick Problem

In the original failure case:

Two orders were prepared due to outdated office instructions

The warehouse had no visibility into which invoice was cancelled

The customer walked off with both packages

No cryptographic enforcement existed tying physical fulfilment to invoice payment

With on-chain anchored logic:

Both the original and amended orders would be pre-encoded as potential UTXO paths

Only one would become spendable based on time, condition, and signature

The warehouse terminal checks the UTXO status: if the original is unspent, pick is valid; if it’s spent (by amendment), it is invalid

The customer can only claim one of the branches — enforced not by policy, but by protocol

Thus, if the invoice is amended and the original UTXO is spent, any attempted pickup using the old reference will fail. Even if the warehouse physically stages both, the validation at the pickup terminal would refuse release of the cancelled package.

V. Communication Layer: Event Propagation via IP-to-IP and Transaction Watching

Between the parties (office → warehouse, warehouse → customer), direct channels using:

Mutual TLS connections

Noise Protocol or Libsodium-based authenticated encryption

Transaction watching over BSV relay infrastructure (e.g., Merchant API, ElectrumX, Teranode)

Each participant is responsible for:

Listening to changes in transaction status

Notifying the counterparty of intent to execute (e.g., “I will pick up Order 472-α at Dock 3”)

Pre-broadcasting their signed transactions for coordination

Verifying whether the UTXO they plan to spend is still valid (i.e., not cancelled, superseded, or timed-out)

This hybrid model—off-chain coordination with on-chain enforcement—provides an elegant, robust solution. It separates signalling (messaging) from proof (execution).

VI. Final Model: Blockchain as Legal Infrastructure, IP-to-IP as Logistics Fabric

The blockchain holds the irrefutable truth: what can be done, what has been done

IP-to-IP communication handles event propagation, scheduling, status notifications

All commercial enforcement relies on deterministic script evaluation, not paper trails or procedural policies

Every terminal (ordering system, warehouse kiosk, collection scanner) becomes a validation agent, not a data-entry point

The entire supply chain, including its error-handling logic, becomes a deterministic machine of proofs

This is not merely process automation. It is the reconstruction of commercial state in a form that cannot be gamed, forgotten, or misaligned. It is truth by design, enacted at the protocol layer, and verifiable by any party at any time. The chain knows no confusion.

Only validity.

Anchoring Supply Chain Execution to Deterministic Blockchain State via IP-Level Coordination and Script-Enforced Transition Logic

By integrating authenticated IP-to-IP messaging with deterministic, script-enforced transitions on-chain, Bitcoin (BSV) transforms supply chain systems into formally verifiable automata, where every physical action—order, amendment, fulfilment, or pickup—is governed by cryptographic proof, not mutable records or procedural trust. Each subsystem (warehouse, office, client) operates as a deterministic state agent, enforcing transitions only when predefined, unforgeable conditions are met. The result is a globally auditable, irreversibly ordered economic state machine, eliminating ambiguity, race conditions, and fraud through provable logic, and ensuring that commercial truth is recorded not as narrative, but as immutable transition.

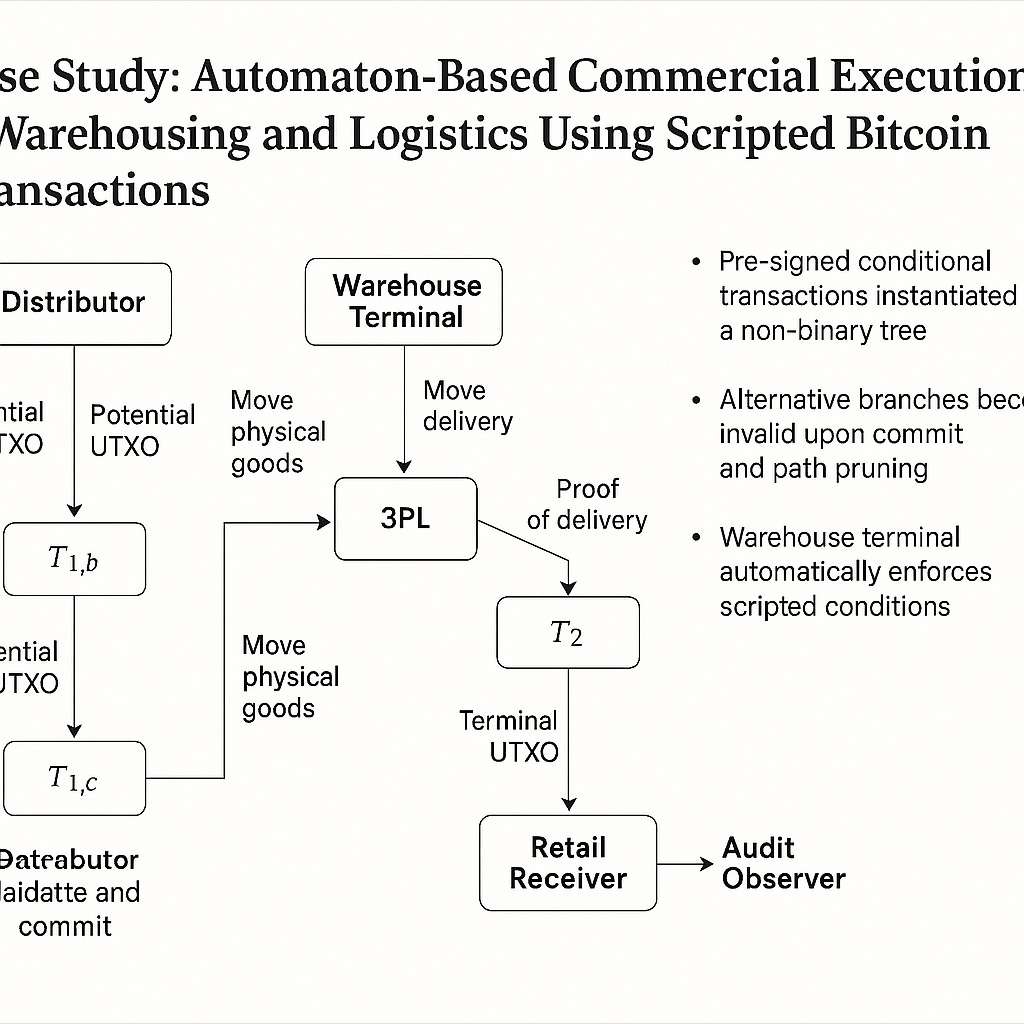

I. Transition Systems in Commercial Logistics — Automata Foundations

From the perspective of formal systems theory, a supply chain can be modelled as a distributed, multi-agent state transition system, where each event (order creation, amendment, fulfilment, handoff, receipt) represents a discrete state transition. Traditionally, these transitions are neither deterministic nor formally modelled: state is represented via mutable records dispersed across heterogeneously administered systems — ERPs, WMS, POS terminals, logistics APIs — with each agent interpreting the global state indirectly and often inconsistently.

Bitcoin, correctly implemented (BSV), allows for the supply chain to be modelled as a Distributed Deterministic Transition Automaton (DDTA):

States are encoded as UTXOs — each representing a tokenised commitment of value and/or contractual condition

Transitions are validated by Bitcoin Script — enforcing precise movement conditions

Inputs act as deterministic witnesses for state satisfaction

Outputs define new states, cryptographically bound to constraints

Edges are mined transactions, forming a DAG of confirmed transitions

In automata theory, this constitutes a finite-state labelled transition system where:

Σ= Alphabet of economic events (payment, shipment, amendment)Q= Set of UTXO configurationsδ: Q × Σ → Q= Transition function encoded via Script conditionsq₀= Genesis state (e.g., uncommitted inventory)F= Set of final configurations (e.g., confirmed delivery and reconciliation)

No state transition is valid unless δ(q, σ) can be computed deterministically as q', with all relevant constraints satisfied — not by messaging consensus, but by proof-carrying transaction state.

II. The Dual Ledger Model — Communication Fabric and Execution Layer

Supply chain systems suffer primarily from bifurcation: the message layer (IP-level API signals, form submissions, status updates) and the execution layer (physical fulfilment, delivery, audit) operate asynchronously and are often misaligned. The proposal here introduces a unified, cryptographically-linked dual-layer model:

Communication Layer

IP-to-IP messaging between actors (order terminals, warehouse systems, courier scanners, customs agents)

Events include: order creation, invoice amendment, stock pick request, loading bay assignment, customer pickup notification

Channels secured via ephemeral ECDH, authenticated via persistent public identity keys

Execution Layer

Every critical event is accompanied by an on-chain UTXO transition, validated by Script

These transitions enforce the validity of physical execution — e.g., a package cannot be picked unless its UTXO proves authorisation

Scripts act as executable guards: they define what must be shown to move to the next state (proof of payment, preimage, digital signature, multi-party unlock)

Each transition corresponds to an edge in a labelled automaton, with the label being both the semantic event and the associated hash-locked constraint. This model reduces execution to functional transition evaluation — no mutable state, no double spend, no replay ambiguity.

III. Script as the Transition Function — Formal Semantics of Control

In a correctly structured logistics chain, each physical transition — e.g., warehouse release, courier pickup, customs clearance — is not triggered by policy, but by the satisfaction of a script.

Formally, Script serves as a validator for δ in the tuple (Q, Σ, δ).

Let:

s₁ ∈ Qbe a UTXO state representing “picked and staged”σbe the event “customer presents invoice and signs pickup”wbe the witness (signature, preimage, timestamp)δ(s₁, σ, w)=s₂is valid ⇔Script(s₁, w) → TRUE

The script must verify:

The customer signature matches the committed pubkey

The pickup occurs within a locked time range

The preimage matches a hash (e.g., SMS or QR code pre-shared)

No conflicting UTXO has been spent (i.e., exclusivity is enforced at the protocol level)

If and only if all are satisfied, the transition occurs. Otherwise, the transaction is invalid and not accepted by the network — invalid transitions cannot occur, even if attempted by a dishonest actor.

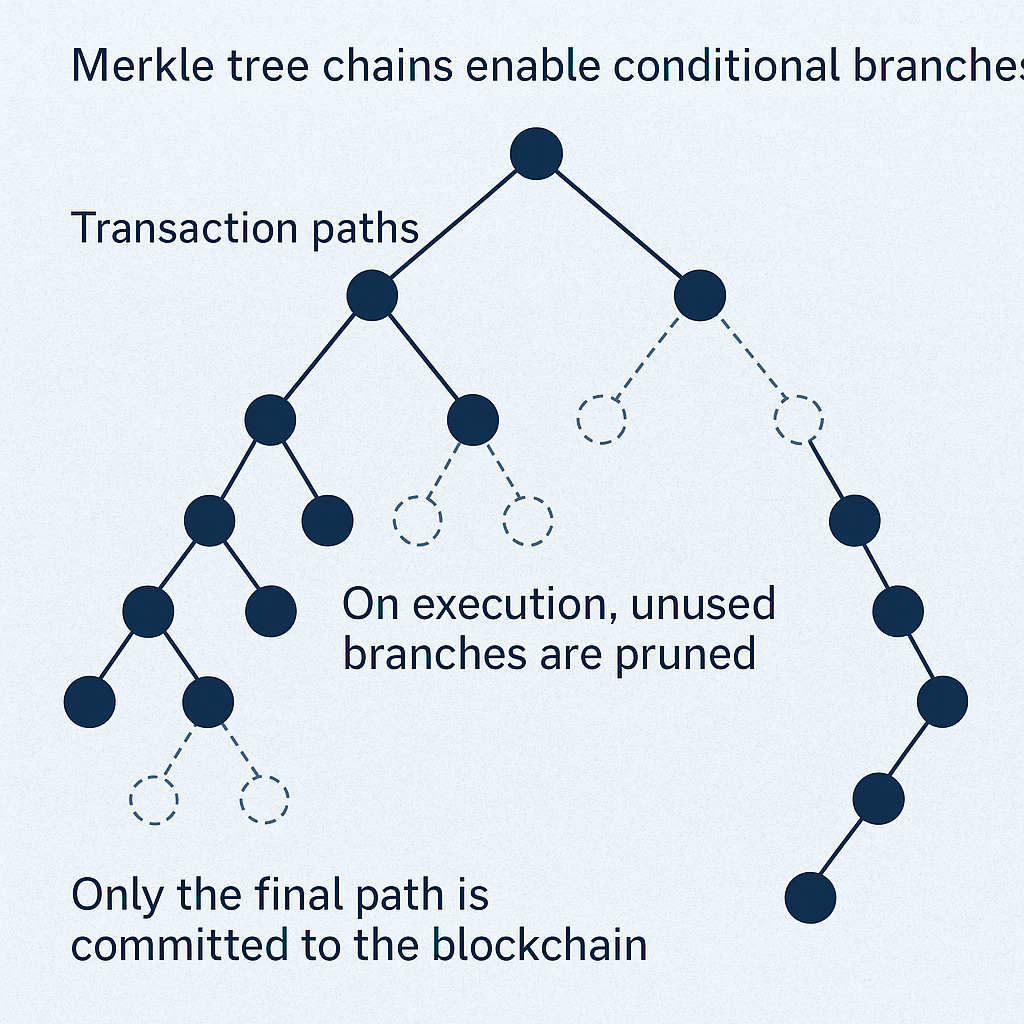

IV. State Composition and Multi-Stage Paths — DAGs of Supply State

Bitcoin’s UTXO model supports non-linear, branching commercial workflows via multi-output scripts and alternative valid transitions. A supply chain is not a simple linear path — it includes:

Multi-point distribution (e.g., one shipment → many retail stores)

Contingency flows (e.g., fallback to supplier if delivery fails)

Delegation flows (e.g., transfer custody to a new courier)

These are modelled via pre-signed but unbroadcast transaction chains, where:

Every future state has a valid transaction encoded, but

Only one path is confirmed through inclusion in the ledger

This mirrors the concept of branching execution trees in nondeterministic automata, except that Bitcoin’s consensus process enforces determinism by selecting a unique path through mining. All possible future paths are structurally known — only one becomes truth.

Each node in the DAG is a transition edge:

Inputs: cryptographically committed state

Outputs: new script conditions

Validity: provable, deterministic, enforced

This allows:

Warehouse systems to know exactly which state an order is in by watching UTXO spends

Customs to enforce control by watching time-locked or authority-locked states

Clients to trust delivery status without API polling — chain state is sufficientV. Terminal Control Points — Linking Physical Access to Script Conditions

At each terminal — warehouse gate, collection kiosk, delivery checkpoint — a thin client (mobile scanner, embedded device, secured tablet) acts as a protocol oracle, not a stateful controller.

Its job:

Fetch UTXO status via SPV or Simplified UTXO Watch (e.g., ElectrumX or Teranode module)

Scan customer QR or NFC signature

Evaluate transaction template with provided witness

If

Script → TRUE, release goods / record pickup / trigger next state

No database lookup is necessary. No state sync is required. The machine enforces a function, not a lookup.

VI. Economic Finality, Not Administrative Reversibility

Legacy systems permit reversals: a shipment can be cancelled via phone call, an invoice voided by database entry, a package rerouted via chat. These are revocable commitments — the source of ambiguity and fraud.

BSV removes this. Every action, once taken and mined, is irreversible. This models commercial truth, not commercial process. Once a customer picks up a package and spends the pickup token, the path is fixed. There is no "undo" — only counter-transitions (e.g., returns, refunds), which themselves must be validated transitions from the new state.

This is not only more secure — it is more legally enforceable. Every actor has proof of their transition, signed and time-anchored. The chain is the audit trail. No argument about who said what. Only provable state changes.

VII. Conclusion: Towards a Formalised, Auditable, Decentralised Commercial Machine

By integrating IP-based authenticated messaging with on-chain transition validation, Bitcoin becomes not just a settlement system, but a universal controller of decentralised state machines for commercial logistics. Every warehouse, every terminal, every customer becomes a node in a synchronised, cryptographically sound transition graph. The state of the world is no longer guessed. It is proven. The flow of goods no longer follows procedural approximations. It follows validated functions. Errors no longer hide in documents. They become provably impossible transitions.

This is not merely EDI on-chain. This is economics as automata, with Bitcoin as the enforcing logic. And it is the foundation for secure, interoperable, and unforgeable supply chain infrastructure for the next century.

Legal and Economic Cost of Intermediated Commerce

Behind the technical failures of EDI lies a deeper cost structure: legal and economic scaffolding constructed to compensate for architectural voids. Because EDI systems cannot enforce execution, they rely on institutional enforcement, contractual ambiguity, and economic externalisation. These dependencies are not incidental. They form the essential economic logic of all EDI-based commerce. Where computation fails to guarantee state, human institutions step in. Where protocols cannot enforce obligations, contracts, courts, insurers, and auditors thrive.

Let us begin with the cost model. In any system where a message cannot be verified, trust must be outsourced. The outsourcing is layered: to internal auditors, external accountants, regulatory frameworks, insurance underwriters, and legal counsel. Each plays a role in resolving disputes that emerge from divergence of belief. The inefficiency is systemic, not incidental. It is inherent to a system that permits syntactically correct yet semantically false statements to pass as commercial actions.

Consider a dispute over non-delivery. Under EDI, a seller transmits an 856 ASN (Advance Shipping Notice), and later an 810 invoice. The buyer remits payment. The goods arrive late or damaged or not at all. The message trail suggests full performance; the physical state contradicts it. The remedy is not computational. It is legal. The buyer must rely on the Uniform Commercial Code (UCC), the Incoterms of the ICC, or other regional legal standards to initiate recourse. This includes documentation, formal notice of breach, and potential litigation. The system does not prevent breach. It presumes it.

Let us formalise the distinction. Let S be the set of syntactically valid EDI message sequences, and let E ⊂ S be the subset that corresponds to fully executed and materially accurate commercial exchanges. There exists no computable function f: S → E such that f(s) = true iff s ∈ E. Instead, f must be evaluated through evidentiary adjudication: document inspection, witness testimony, audit trails, forensic analysis. This is economic deadweight: it adds no productive value, only compensates for protocol insufficiency.

The legal frameworks that support this are structurally conservative. UCC §2-201 (Statute of Frauds) requires contracts for the sale of goods over $500 to be in writing, signed, and sufficiently definite. Yet the standard of “writing” includes electronic messages, which need not be cryptographically signed or deterministically verifiable. As such, the law presumes good faith and allocates burden of proof based on presumptive delivery, customary practice, and transactional history—not formal state machines. These assumptions institutionalise ambiguity.

Insurance fills another role: it monetises failure. In international trade, marine cargo insurance, political risk coverage, and trade credit insurance exist not because shipping is inherently dangerous, but because the commercial record is unverifiable. If delivery and payment were atomically linked—if state transitions were enforced at protocol level—then most categories of trade insurance would become obsolete. Their cost reflects system weakness, not economic necessity.

Auditing is likewise a compensatory mechanism. The audit exists because internal records are mutable and divergent. If transactions were enforced through globally visible, cryptographically bound commitments, there would be no audit gap. Each action would be public, immutable, and irreversibly committed. Yet in the EDI model, audit trails are local artefacts: logs, spreadsheets, XML snapshots. They require external verification, sampling, and reconciliation. This is not validation. It is approximation.

The economic burden is staggering. Estimates from the World Bank and OECD suggest that inefficiencies in trade finance—driven primarily by documentation, reconciliation, and settlement delay—consume 5–10% of global transaction value. In highly intermediated verticals such as commodities, pharmaceuticals, and aerospace, as much as 30% of operational cost stems from dispute resolution, exception handling, and coordination overhead. These are not optional costs. They are direct functions of a protocol incapable of guaranteeing truth.

Let us reframe the question. Suppose instead that each commercial action—purchase order, shipment, receipt, payment—was a state transition on a deterministic ledger. Let σₖ represent the commercial state at time k, and let t be a transaction such that σₖ₊₁ = t(σₖ). If t is valid, the state transition is committed; if not, it is rejected. The conditions are encoded in Script: OP_IF, OP_CHECKSIG, OP_EQUALVERIFY, etc. No external system is needed to adjudicate. There is no ambiguity, no duplicate logs, no audit reconciliation. The action enforces itself.

This model does not eliminate law, but it repositions it. Contracts become constraints encoded in executable logic. Insurance becomes optional, not necessary. Audits become monitoring, not validation. The role of human institutions shifts from interpretation to oversight.

The legacy model thrives on opacity. It creates a secondary economy—lawyers, underwriters, auditors, consultants—whose role is to simulate confidence in a system structurally incapable of enforcing it. Bitcoin collapses that economy by removing the ambiguity that sustains it.

Commerce should not be a matter of trust, remedy, and approximation. It should be a matter of computation, execution, and proof. Until that transformation is complete, legal and economic deadweight will continue to dominate global trade—not because it is necessary, but because the substrate is broken.

Towards Deterministic Commercial State

Commerce is, at root, the transformation of claims into commitments—of promises into provable, irreversible transitions in the allocation of resources. The failure of Electronic Data Interchange (EDI) is not that it fails to carry messages, nor that it cannot simulate workflows, but that it fails to enforce state. Its architecture is fundamentally non-deterministic: multiple actors interpret messages in divergent contexts, each applying mutable logic to partial representations of commercial activity. There is no formal state machine, no canonical source of truth, no global function f such that f(s₀, m₁, m₂, ..., mₙ) = sₙ, where sᵢ are commercial states and mᵢ are protocol-defined transitions. Instead, there are only messages and local interpretations.

The requirement is now inescapable: we must build a system of deterministic commercial state, in which every action is both a declaration and an execution, and every transition is not merely visible, but provable. That is, each commercial event—shipment, receipt, payment—must be encoded as a transaction on a system in which the only possible state change is one that satisfies a set of public, immutable rules. This is not a desire for better infrastructure. It is a demand for computational enforceability.

To formalise this transition, consider the classical model:

Let 𝔐 be the set of EDI messages.

Let ℙ be the set of internal programmatic rules within each participant’s system.

Let Σ be the space of all commercial states.

In EDI, for any message m ∈ 𝔐, the corresponding state update σᵢ₊₁ = P(m, σᵢ) is not globally visible, not reproducible, and not enforceable. Each P is private, mutable, undocumented. There is no consensus engine. No participant can reconstruct the state of trade by inspecting the messages alone, because the interpretation space is undefined and non-commutative.

Now contrast this with the Bitcoin model:

Transactions are state transitions.

Each transaction is a tuple t = (σᵢ, σᵢ₊₁, π), where π is a proof: a cryptographic witness that σᵢ₊₁ is a valid successor of σᵢ under the rules of the scripting language.

The system enforces σᵢ₊₁ = T(σᵢ) only if π ⊨ Script.

This structure is self-validating. No external verification is needed. No manual reconciliation is required. The execution of the transaction proves the action. Nothing more is necessary.

The consequence is revolutionary. In this model:

Delivery can be enforced as a requirement for payment.

Receipt can be tied to a signature that enables the release of funds.

Payment can be conditional, divisible, and redistributable—all encoded within Script.

Audit becomes trivial: all valid transitions are in the ledger; all invalid attempts are excluded by protocol.

From a distributed systems perspective, this structure yields consistency by design. There is no need for eventual consistency, CRDTs, or reconciliation algorithms. The ledger is the state. From a legal perspective, the transaction is the contract. From an economic perspective, cost is paid only for action—not for verification, litigation, or resolution.

Bitcoin Script—Turing-(in)complete, stateless between invocations, and designed for bounded execution—forces determinism (note a 2PDA is complete over transactions). There are no loops. No dynamic memory. Every path must resolve. This is not a weakness—it is a constraint that ensures that every transaction can be evaluated identically by every participant. There is no ambiguity. No divergence. The result is not a simulation of agreement—it is agreement by construction.

In practical terms, this enables a new architecture for commerce:

Each purchase order becomes a script-locked UTXO: a commitment that can only be spent if delivery and confirmation conditions are met.

Each invoice becomes a transaction attempt: an execution that only succeeds if the buyer’s policy script is satisfied.

Each payment is not a separate act—it is the successful execution of the contract that proves the commercial event occurred.

This architecture does not transmit intention. It enforces action.

The EDI system is a simulation—an expensive, fragile, ambiguous simulation—of commercial truth. Bitcoin, in contrast, is not a simulation. It is a state machine. One in which every step is irreversible, every condition visible, and every transition verified through computation, not adjudication.

The movement from messages to transactions is not merely technical. It is epistemological. It changes what it means to know something occurred in commerce. Under EDI, we believe based on documents. Under Bitcoin, we verify through execution.

In the next section, we will demonstrate how this deterministic structure radically reduces commercial cost—not hypothetically, but mechanically—by eliminating trust, duplication, ambiguity, and dispute. A system that enforces its own state is not an improvement. It is a categorical replacement. It is computation.

Not correspondence.

The Economic Model of On-Chain Truth

The cost of commerce under legacy infrastructure is not the cost of producing goods or transporting them. It is not even the cost of capital or warehousing. It is the cost of verifying truth in an environment where no truth is guaranteed. Every reconciliation cycle, every audit process, every contract dispute, every insurance premium, and every line of compliance software exists because commercial systems do not enforce reality by design. This cost is enormous. It is structural. And it is invisible until made obsolete.

To measure it, consider a standard purchase-to-pay cycle. A purchase order is issued, a shipment is made, an invoice is generated, and a payment is authorised. In a system based on EDI or cloud APIs, each stage requires an independent confirmation. Inventory systems must match shipping records. Invoice terms must be validated against purchase agreements. Payment must be posted and matched. Each of these steps involves human coordination, software integration, error handling, and tolerance for conflict.

Let us formalise this burden. Let C be the total cost of a commercial transaction. Under the traditional model:

C = cₚ + cₛ + cᵥ + cᵣ + cₐ + cₗ

Where:

cₚ is the cost of protocol-level messaging (EDI/API transmission fees)

cₛ is the cost of software integration and maintenance

cᵥ is the cost of verification (internal controls, matching engines, exception management)

cᵣ is the cost of reconciliation between systems

cₐ is the cost of auditing (internal and external)

cₗ is the cost of legal and dispute resolution processes

Each of these terms is positive because each exists to compensate for the system’s lack of enforceable state. That is, the messaging system cannot itself confirm that a given transaction is real. It requires interpretive effort and trust-based validation at every step.

Now consider the alternative: a system in which every commercial action is an on-chain transaction, enforced through Bitcoin Script, published on a global ledger, and validated by all participants. In this model:

C' = cₜ + ε

Where:

cₜ is the transaction fee paid to miners (denominated in satoshis)

ε is an arbitrarily small operational overhead for local interaction (e.g., transaction construction)

Every other cost—cᵥ, cᵣ, cₐ, cₗ—is eliminated. Reconciliation disappears because there is only one state. Auditing disappears because the ledger is immutable. Verification disappears because script evaluation is deterministic and final. Legal costs drop to zero in all cases where contractual behaviour is governed entirely by script logic.

From an economic perspective, this transformation is radical. The Bitcoin ledger becomes a public enforcement engine, where every transition is backed by proof-of-work, broadcast to all parties, and irreversible once mined. The cost of asserting a fact (e.g., “payment received,” “goods delivered,” “invoice settled”) is the cost of encoding that fact as a transaction and having it accepted into the canonical chain.

This is a world where:

The truth is publishable.

The cost of lying is provable rejection.

The cost of enforcement is zero, because enforcement is computation.

Let us now restate this formally. Let T be the set of all valid transitions, and let L be the ledger. Then:

If t ∈ T ⇒ t ∈ L

If t ∉ T ⇒ t ∉ L

That is, the ledger includes only those transitions that satisfy the validation rules—including time locks, digital signatures, hash locks, and policy constraints. This turns commerce into a closed, composable system of state machines. Every step is machine-checked. Every change is visible. Every claim is tested by execution, not interpretation.

The traditional model makes truth expensive. The Bitcoin model makes truth free after publication. The only cost is the act of proving, and that act is paid once per transaction, not per party. The result is a commerce stack where publication replaces reconciliation and execution replaces negotiation.

This is not theoretical. It is happening. Each time a business encodes a conditional payment in a script, or a delivery proof in a hash, or a chain of custody in a Merkle path, it exits the world of human trust and enters the world of computable truth.

Commerce under EDI is bureaucracy. Commerce under Script is logic. The former defers cost by spreading it across departments and delays. The latter collapses cost by absorbing it into code. The economic model of on-chain truth is not just more efficient—it is deflationary by design. It reduces cost not at the margin, but at the root. It does not streamline coordination. It abolishes the need for it.

The only remaining costs are the ones that prove you’re telling the truth. Everything else is discarded, because nothing else is needed.

Summary and Forward Reference

Electronic Data Interchange is not a failure of intent. It is a failure of architecture. It attempts to automate commerce by encoding intention as message formats—yet it cannot enforce that intention, verify its execution, or bind it irreversibly to outcomes. This is not due to technical limitations of past decades, but to a structural flaw: EDI assumes that truth can be reconstructed through communication. It cannot. Truth in commerce must be executed, not merely asserted.

Over the course of this chapter, we have traced this failure across ten interlocking dimensions:

EDI’s Historical Origins: Built from punch cards and fixed-width encodings, EDI grew by formalising message layout, not transactional logic. It preserved syntax while deferring semantics.

Centralised Control: VANs, API providers, and cloud EDI systems became interpretive authorities—not neutral relays. They inserted opacity and fragility into what should be deterministic processes.

API Modernisation Illusion: REST, JSON, and cloud orchestration did not fix this; they accelerated failure by obscuring it with mutable, black-box systems.

Decoupled Payments: Value transfer occurs in a different system from messaging, destroying atomicity and enabling fraud, denial, and delay.

Epistemic Fragmentation: Every participant maintains a different record of the same event, requiring reconciliation, audit, and dispute management.

Message-Level Success, Commercial Failure: Transactions can “succeed” in the EDI system while failing catastrophically in the real world—because message success ≠ event truth.

Legal and Institutional Deadweight: Insurance, compliance, dispute resolution, and regulation exist largely to patch a world where software cannot guarantee outcome.

Lack of Determinism: There is no global state machine, no transaction ledger, no provable function of state—only logs, interpreted variably.

Economic Cost: Billions are spent annually on overhead that exists solely to simulate verification—coordination that becomes unnecessary once computation guarantees execution.

Architectural Contradiction: EDI declares intentions through structure, yet relies on humans and institutions to determine whether those declarations were true.

Against this backdrop, Bitcoin emerges not as a payments system, nor as a speculative asset, but as a deterministic, shared-state ledger for encoding commercial truth. Its transaction model, when understood correctly, is not just an innovation in digital value transfer—it is a replacement for the entire class of systems built on interpretive messaging.

In Bitcoin:

There is no need to reconcile—because every party reads the same state.

There is no need to audit—because the ledger is cryptographically immutable.

There is no need to verify post hoc—because validation is performed at execution.

There is no need to trust—because every claim must be proven before state changes.

Commerce becomes deterministic. Execution replaces intention. Code replaces contracts. Cost is shifted from enforcement to construction: one must build a valid transaction, or nothing happens.

The remainder of this book builds the replacement. We will:

Construct a full Electronic Data Interchange system over Bitcoin Script.

Define canonical formats for structured transactional data.

Encode not just value, but event logic and message flow into spendable outputs.

Use deterministic scripts to model delivery, receipt, invoicing, settlement, rerouting, partial shipment, refunding, and recomposition.

Eliminate ambiguity by enforcing facts as executable commitments on-chain.

In the next chapter, we begin with the core substrate: the Bitcoin scripting language itself—not as folklore, not as misunderstood legacy, but as a domain-specific language for conditional state transition, constrained in power but maximally expressive in structure.