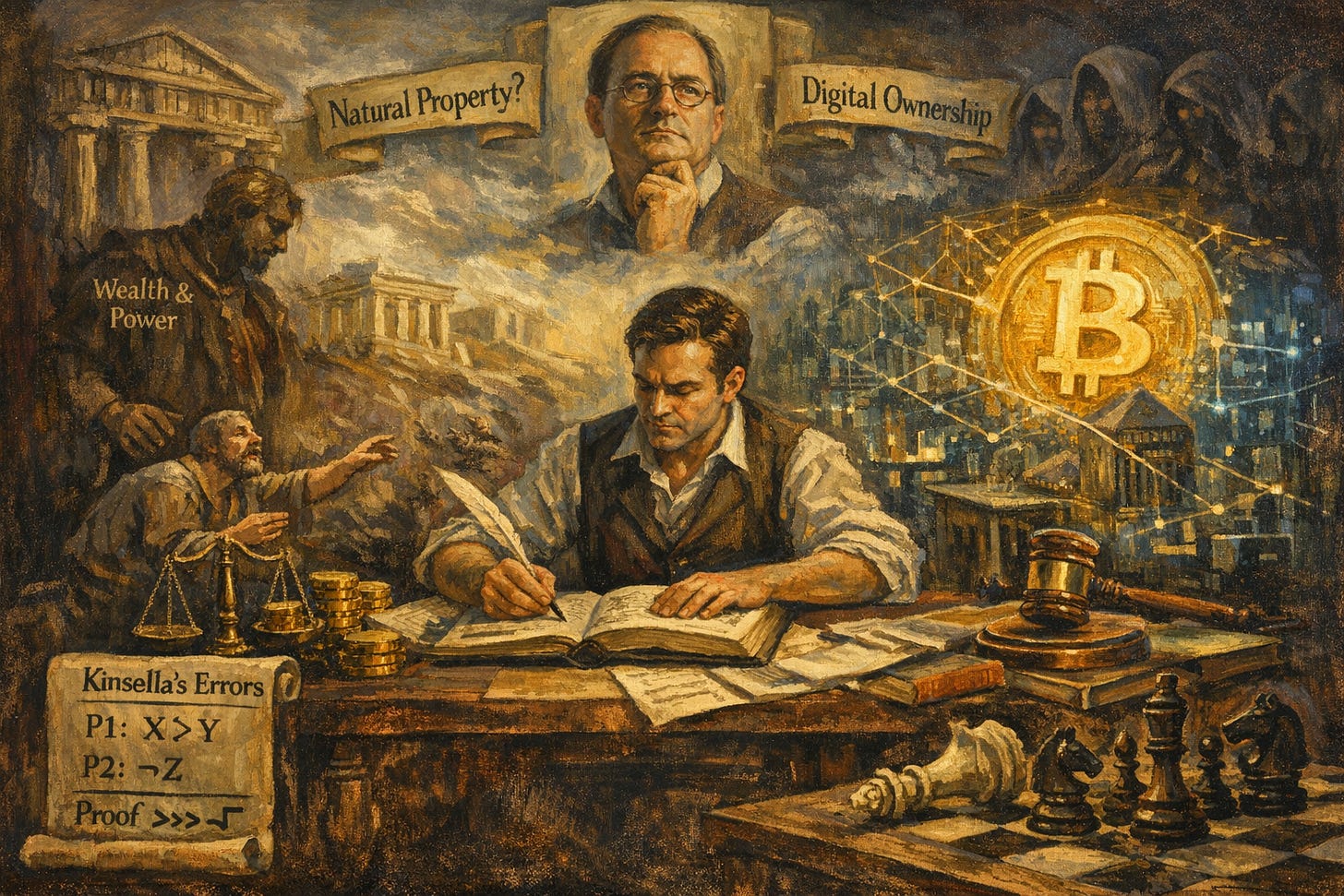

Your Property Rights Don’t Exist Without a State — And That’s Not a Moral Claim

A formal proof that stateless property enforcement cannot protect the weak, and why Bitcoin proves Kinsella wrong about digital ownership

There is a popular argument in anarco-libertarian circles that goes like this: property rights exist to manage scarce resources and avoid conflict. The state is an aggressive monopolist. Therefore, competing private agencies can handle property enforcement without a state. And since information isn’t scarce in the way land is scarce, digital things can never be property.

Every part of this argument after the first sentence is wrong.

I don’t mean wrong in the sense of “I disagree with the values.” I mean wrong in the sense of “the conclusion does not follow from the premises.” The institutional form that the argument rejects — monopoly final authority — is the institutional form required to deliver the function the argument demands. And the hidden premise that only physical things can be scarce is falsified by hundreds of billions of dollars in global commerce every single day.

This post lays out the proof. It is adapted from a formal paper now under submission to the Journal of Institutional Economics, but the core logic is accessible to anyone who has ever had a boundary dispute, hired a lawyer, or wondered why their land title is worth anything at all. What you’re about to read is not a political opinion. It is a structural argument about what institutions must look like if property is to mean anything at all — and why the most important property innovation of this century works precisely because it acts as a state for the digital domain.

The Target

The argument I’m addressing was developed most systematically by Stephan Kinsella, a libertarian legal theorist whose “Against Intellectual Property” (2001) remains the most widely cited case against IP from a libertarian framework. His claims, reconstructed here in their strongest available form, are:

C1. Property rights are justified because they allocate exclusive control of scarce resources to avoid conflict and enable peaceful cooperation.

C2. Scarcity, for the purpose of property theory, requires physical rivalrousness — the condition where two people can’t simultaneously use the same resource without conflict. Two people can’t stand on the same square metre. That’s scarcity. Two people can both read the same book simultaneously. That’s not.

C3. Institutional norms can’t “create” scarcity without contradiction. Scarcity is a natural, pre-institutional fact that exists before any legal system codifies it.

C4. A “private law society” — a polycentric legal order of competing enforcement and adjudication agencies — can deliver the conflict-avoidance function of property without any monopoly state authority.

C5. Therefore, intellectual property can’t be property (from C1–C3), and the state isn’t necessary for property enforcement (from C4).

I accept C1. Property is about conflict avoidance over scarce resources. That’s the right functional definition, and I adopt it as my starting premise. Then I use it to demolish C2, C3, and C4 — and with them, C5.

The method is what cryptographers call an “adversarial” proof: assume worst-case behaviour by all actors. Not average-case. Not “most people are decent and reputation will sort it out.” Worst-case. A property system that only works when everyone cooperates is not a property system. It’s a gentleman’s agreement. Property, by its functional definition, must work against people who refuse to cooperate. That is its entire purpose. If your property theory only functions among friends, it is useless precisely where property matters most.

What Would Prove Me Wrong

Before I go further, let me state what would falsify my thesis — because serious arguments come with falsification conditions, and I want this to be a serious argument.

My central claim would be wrong if someone could demonstrate a polycentric enforcement system that simultaneously: (i) binds defectors who don’t consent to its jurisdiction; (ii) produces final, non-appealable outcomes that rival agencies can’t override; (iii) does this at a cost the victim can actually afford; (iv) remains stable under wealth concentration and institutional capture; and (v) achieves all of this without using any mechanism that constitutes compulsory jurisdiction, compulsory registry, or compulsory fiduciary oversight — since each of those is, by definition, a monopoly function.

If you can design that system, my argument collapses. Nobody has. The rest of this post explains why nobody can.

My secondary claim — that digital tokens are genuine property — would be wrong if someone can show that radio spectrum, domain names, and Bitcoin fail to satisfy the functional criteria of rivalrousness, excludability, and conflict-generating scarcity that Kinsella himself identifies in C1. I do not believe this can be done.

The Enforcement Gap Nobody Talks About

Here is the question Kinsella never asks, and it is the question that should come first: before we debate what kinds of things can be property, what institutional framework makes property possible at all?

Property is not self-executing. A title — whether it’s a piece of paper, a ledger entry, a deed, or a social convention — says you own something. It does not, by itself, stop someone from taking it. For the title to mean anything more than a wish, there must be a system that can determine its validity when contested, publicise it so third parties can rely on it, and enforce it against people who don’t care what the title says.

Think about what your house is actually worth. Not the building — the title. Your title to your house is worth something because, if someone disputes it, there exists a court with compulsory jurisdiction that will hear the case whether the other party likes it or not, a registry of publicly authoritative title records that settles who owns what, and an enforcement mechanism (sheriffs, bailiffs, ultimately police) that will execute the judgment. Remove any one of those three components, and your title is worth whatever you can personally enforce. If you’re strong and well-armed, it might still be worth something. If you’re elderly, disabled, or simply less wealthy than your neighbour, it’s worth nothing. It’s a piece of paper.

Now consider what that system must actually do. It must bind defectors — people who won’t consent, won’t arbitrate, won’t cooperate. A thief doesn’t consent to the jurisdiction of the court that convicts him. The entire point is that the system works on him anyway. It must produce genuinely final outcomes — not “final unless someone else’s agency objects,” but terminal decisions that end the dispute. If the loser can simply hire a different arbitrator who issues a contradictory ruling, nothing is final. It must prevent defendants from vetoing jurisdiction forever — because if jurisdiction requires consent, the wrongdoer simply withholds consent. It must terminate meta-disputes about which judge applies, which evidence rules govern, which appeal process controls, so that procedure doesn’t become a weapon used by the rich to exhaust the poor. It must provide public, authoritative standards for title, boundaries, and priority — because if three different registries say three different people own the same plot, nobody really owns it. And it must do all of this at a cost below the value of the rights being protected — otherwise the right exists on paper but is unenforceable in practice, and a right you can’t enforce is not a right.

These aren’t my requirements arbitrarily imposed from outside. They’re derived directly from C1 — Kinsella’s own functional definition. If property must resolve conflict over scarcity, then the system delivering property must be able to actually resolve conflicts. Against people who don’t want them resolved. Against people who are richer, more powerful, and better connected than the person whose rights are being violated. That is what property enforcement means.

Why Polycentric Enforcement Fails: Three Models

The formal paper identifies twenty-three specific structural failure mechanisms. Here I’ll focus on the three game-theoretic models that carry the proof’s central weight. Each one models a specific failure, proves it as a formal equilibrium result, and then tests whether proposed “repair mechanisms” (bonds, reputation, charters, escrow, auditors) can fix it. This last step — the commitment-device extension — is the decisive move. In every case, the repair either fails or reintroduces the monopoly function it was designed to avoid.

Model 1: The Forum Veto Game

Imagine a weak homesteader and a strong mining company disputing subsurface rights to the same piece of land. Each has hired a protection agency. The homesteader’s agency proposes arbitration before a neutral forum. The mining company’s agency rejects it and proposes a different arbitrator — one whose evidentiary rules and fee structure happen to favour parties with deep pockets. The homesteader’s agency objects. Another proposal. Another rejection. Another counter-proposal.

In a state system, this terminates when a court with compulsory jurisdiction issues a ruling. In Kinsella’s polycentric system, there is no authority that can compel the mining company to accept any forum it doesn’t choose. No court can say “you will appear here on Tuesday whether you like it or not.” The process terminates when one party gives up. And the party that gives up is structurally, mathematically, inevitably the one with fewer resources.

The formal model proves this by backward induction — the standard technique for solving sequential games. Start at the end. At the final round of negotiation, if no forum has been agreed, the status quo prevails: whoever is in physical possession keeps the resource. In the typical dispute, that’s the strong party who has already encroached or seized the contested asset. Now step back one round. The strong party’s agency knows that rejection at this stage leads to the status quo, which favours the strong party. So the strong party’s agency rejects. Step back another round. Same logic. By induction, the strong party’s agency rejects every proposed forum at every round, as long as two conditions hold: the weak party can’t afford to enforce unilaterally (their enforcement cost exceeds the value of their claim), and the strong party can profitably enforce if needed (their enforcement cost is below their gain from keeping the resource).

The unique subgame-perfect equilibrium is: the strong party vetoes all forums; the weak party rationally accepts dispossession. This isn’t a “sometimes things go wrong” observation. It’s a mathematical certainty under the stated conditions. The strong party’s veto is a dominant strategy — it’s at least as good as accepting in every scenario and strictly better whenever the forum would rule against them. The weak party’s surrender is the only rational response — fighting costs more than the asset is worth.

Now the critical move that separates this analysis from ordinary critique. What if the parties post bonds — forfeitable deposits payable upon forum refusal? For the bond to discipline the strong party, the bond amount must exceed their gain from veto. But enforcing bond forfeiture itself requires a terminal authority to determine whether refusal occurred, to adjudicate disputes about the bond, and to execute forfeiture against a non-consenting party. That authority must be compulsory — it can’t be subject to veto by the party whose bond is being forfeited, or we’re back where we started. Compulsory jurisdiction exercised as a monopoly within a territory is a state.

What about reputation? The strong party’s agency is rewarded by its client for successful veto — the client is paying for exactly this service. Reputational punishment requires coordinated ostracism by other agencies, which is itself a form of compulsory exclusion: a monopoly function. And there is always a profitable niche in selling non-compliance to clients willing to pay a premium for it. The “bad agency” serves defectors; its business model depends on reputation for toughness, not for cooperation. Niche agencies have no broad-market reputation to lose.

Every repair either fails under adversarial conditions or reintroduces the state-function.

Model 2: The Enforcement Market Game

Your protection agency is a profit-maximising firm. You pay it premiums every month. It’s supposed to defend your property rights. You trust it the way you trust your insurance company — it’s a market relationship.

Now a strong adversary — someone much wealthier than you — disputes your claim to a piece of land, a business asset, or a financial position. They don’t approach you. They approach your agency with an offer: “Settle this in my favour. I’ll pay you more than this client will ever pay you in their entire lifetime of premium payments.”

Your agency’s decision is straightforward arithmetic. The present discounted value of your lifetime premium stream is some amount P. The strong party offers P plus a small margin. Since the strong party’s surplus wealth vastly exceeds your premium payments, this offer is always feasible — they can always outbid you for your own protector’s loyalty. The sell-out doesn’t need to be crude. It takes the form of a “commercial settlement” — a “best achievable outcome” that your agency presents to you as a reasonable compromise given the circumstances. You have no way to know the settlement was purchased, because the side-payment is invisible to you, disguised as a professional judgment call.

You have no recourse. No court of appeal, because there’s no compulsory appellate jurisdiction. No ombudsman, because there’s no regulatory body with binding authority. No disciplinary body that can sanction your agency, because any such body would need compulsory jurisdiction over agencies — which is monopoly authority.

The formal model proves this as the unique equilibrium: the strong party offers the buyout; the agency accepts; the weak party loses. Your property right is worth exactly zero because your protector is purchasable.

This model also derives what I call the “justice floor” — a concept with profound implications. Define the total expected cost of enforcing a single property right: investigation (who did what?), adjudication (who’s right?), enforcement (making the loser comply). Add them up. For any asset worth less than that total cost, even a perfectly honest agency — one that would never accept a side-payment — rationally refuses to defend the claim, because defence costs more than the asset is worth. The justice floor is the threshold below which property rights don’t exist in practice. In a state system, this justice floor is partially socialised through taxation: courts are publicly funded and available to everyone regardless of the value of their claim. Small claims courts exist precisely to lower this floor. Legal aid lowers it further. In a polycentric system, the full cost falls on the victim. Below the justice floor, you’re in a state of nature. Your “rights” are nominal — they exist on paper and nowhere else.

What about auditors monitoring the agency for sell-out? The auditor faces the identical problem: the strong party can buy the auditor’s compliance. What about an auditor of the auditor? Same problem, one level up. The regression terminates only when you reach a non-purchasable authority — one whose mandate is enforced by constitutional law rather than market incentives. That’s a state.

Model 3: The Institutional Drift Game

Competing institutions — arbiters, registries, enforcement agencies — need revenue to survive. Revenue comes from clients. Strong clients pay more. Much more. The largest corporate clients of a private arbitration firm pay hundreds of times what individual homeowners pay. So the revenue-maximising institutional standard is the one preferred by strong clients.

What do strong clients want from their legal system? Higher evidentiary burdens for claims against them, making it harder to prove their wrongdoing. Shorter limitation periods for their own liabilities, so claims against them expire quickly. More expensive procedures that only the wealthy can endure, creating a filtration effect. More complex filing requirements. Longer appeal chains. Nothing explicitly discriminatory — just expensive, slow, and complicated enough that it structurally filters out the poor. The law remains formally neutral. The outcomes track money.

The model formalises this as a Hotelling-type spatial competition game. Each institution chooses where to position itself on a spectrum of legal standards. Strong clients pay R_S per period; weak clients pay R_W, where R_S is vastly larger than R_W. The revenue-maximising position is the one that attracts strong clients, even at the expense of losing weak ones. An institution that positions itself near the standards preferred by weak clients — low fees, fast resolution, simple procedures, long limitation periods — earns less revenue and is outcompeted by institutions positioning themselves near the strong-client optimum. Institutions that cater to weak clients go bankrupt.

In the long-run competitive equilibrium, all surviving institutions converge on the standards preferred by dominant payers. “Law” tracks money. Formal neutrality is maintained — no institution explicitly says “we favour the rich” — but the effect is systematic, structural disadvantage for the weak. This isn’t corruption. It’s worse than corruption. It’s the market working exactly as designed.

This is a genuinely counterintuitive result worth sitting with. In most markets, competition improves consumer welfare. More restaurants mean better food at lower prices. More airlines mean cheaper flights. But in the enforcement market, competition worsens outcomes for the weak because the “consumer” whose preferences shape the product is the one who pays more. Polycentric competition doesn’t discipline enforcement agencies on behalf of the weak; it disciplines them on behalf of the wealthy. Competition amplifies inequality in the one market where equality matters most.

What about institutional charters — constitutions that bind providers to neutral standards? For the charter to constrain drift, it must be enforceable by some authority external to the institution itself, since the institution controls its own charter interpretation. If that external authority is voluntary, the institution exits the charter network when drift becomes profitable — and it will become profitable, because the revenue incentive is structural and permanent. If the external authority is compulsory, it’s a regulatory body with monopoly oversight power. A state.

The Impossibility Result

From these three models, their commitment-device extensions, and twenty-three supporting lemmas, the paper proves:

Conditional Impossibility Theorem. Given open entry to enforcement markets, non-consenting defectors, costly attribution, wealth asymmetry, and payer concentration, any polycentric enforcement order that does not impose compulsory jurisdiction, compulsory registry, or compulsory fiduciary constraint cannot simultaneously deliver enforceability and finality for weak agents.

And a minimal-assumption-set proposition: any polycentric order that defeats forum veto must impose compulsory forum selection. Any that defeats registry fragmentation must impose a compulsory meta-registry. Any that defeats agency sell-out must impose enforceable fiduciary duties with compulsory oversight. Each necessary repair constitutes a monopoly terminal authority — a state-in-function.

An important remark on the conditionality: the conditions under which this result holds — wealth asymmetry, payer concentration, non-consenting defectors — are not exotic edge cases. They are the defining conditions that property theory exists to handle. Enforcement problems arise precisely when claims are contested under unequal power. A property theory that functions only when parties are roughly equal in resources and willingness to cooperate is not a theory of property. It is a theory of harmony. The adversarial condition is the condition property was invented for.

What About State Capture?

A fair objection: if polycentric enforcement is captured by the wealthy, isn’t the state captured too? Yes. States are captured, courts are biased, legislatures are lobbied, enforcement is uneven. I’m not claiming the state is ideal or efficient or morally virtuous. The comparative claim is narrower and more precise.

Monopoly authority with constitutional constraint dominates polycentricity under the conditions specified. Not because monopoly is perfect, but because its failure modes are structurally different and more amenable to repair.

A monopoly court system has one final authority. Capture of that authority is a single-point problem amenable to constitutional safeguards: separation of powers, judicial independence, appellate review, transparency, public accountability, and the right to challenge biased judges. In a polycentric order, every agency, every forum, and every registry is a veto point, and the strong can exploit any one of them. The problem is not single-point capture but distributed, multiplicative veto — a structural feature, not a bug that can be patched.

A monopoly registry eliminates title double-spend: one authoritative record that everyone can rely on. Corruption of that registry is a monitoring problem amenable to audit and public access. In a polycentric order, the problem isn’t registry corruption but registry multiplication, which is structurally unresolvable without a meta-registry that must itself be compulsory.

Both systems are imperfect. But the failure modes of monopoly are amenable to institutional repair through constitutional norms, separation of powers, judicial independence, transparency, and audit. The failure modes of polycentricity are structural, and every repair imports the very monopoly functions the theory was designed to eliminate. The libertarian who fixes polycentric enforcement has built a state and called it something else.

Digital Property: The Part Kinsella Gets Catastrophically Wrong

The enforcement analysis has a direct bearing on digital property. Before asking “what kinds of things can be property?” you must have a working enforcement framework. Kinsella skips this entirely and jumps to ontological questions about which things are “truly scarce.” But the enforcement framework he proposes is structurally broken.

Three Categories, Not Two

Kinsella assumes a binary: physical things (which can be property) and non-physical things (which can’t). This binary misses an enormous category sitting in the middle. For property purposes, resources actually fall into three categories:

Category I: Physically rivalrous goods. Land, cars, food. Scarcity arises from physics. Institutions allocate.

Category II: Rivalrous positions created by systems. Bank balances, corporate shares, domain names, spectrum licences, blockchain tokens. Scarcity is institutional, but rivalrousness is genuine — two holders cannot simultaneously control the same position. Your bank balance is not a physical object you can touch. But your bank and my bank cannot both claim the same £10,000 sits in both our accounts. That’s institutional scarcity, and it’s absolutely real. It generates real conflicts. It requires real property rules to manage.

Category III: Non-rivalrous information. Pure copying doesn’t deplete the thing. The only rivalry is legally imposed (copyright, patent).

Here’s the devastating point: Category II already refutes the physicalist premise. You cannot simultaneously hold that “only physical things can be property” and accept that bank balances, dematerialised shares, spectrum licences, emissions allowances, taxi medallions, and domain names are property. They are. They obviously are. They’re traded, litigated, taxed, insured, collateralised, inherited, and enforced as property across every legal system on earth. Trillions of dollars of global commerce operate through Category II property every single day.

Once Category II is conceded, the debate about IP shifts from a conceptual question (”can non-physical things be property?”) to a normative question (”should the law grant exclusion over non-rivalrous information?”). That’s a legitimate debate, and reasonable people disagree. But it’s a different debate — one that cannot be won by the conceptual argument that “only physical things can be property,” because that argument has already been refuted by Category II.

The Three-Way Distinction That Kills the “Right-Click Save” Objection

Kinsella and his followers collapse three categorically different things into one:

A digital file. Copyable information. Non-rivalrous. Kinsella is correct that copyable files can’t be property in the exclusion-right sense. I agree.

A copyright. A state-granted monopoly over a pattern. Traditional IP. Restricts what others can do with their own resources — their own printers, computers, vocal cords.

An NFT — a token on a distributed ledger. A unique, non-duplicable ledger entry. Rivalrous (only one address controls it at any time — this is enforced by the protocol, not by law). Excludable (private key cryptography). Scarce (protocol-limited supply). Transferable. Persistent. Programmable.

The “right-click save” objection — “I can just save the image, so the NFT is worthless” — confuses the file (Category 1) with the token (Category 2). You can photograph a land title certificate. That doesn’t give you the land. You can screenshot a bank statement showing a million-pound balance. That doesn’t give you a million pounds. The file is the representation; the token is the position on the ledger. They are not the same thing, and confusing them is a category error with embarrassing consequences.

And here’s the point that should end the debate within libertarian circles: token property is categorically distinct from IP. IP restricts what others can do with their own resources — it prevents you from using your own printer to reproduce a pattern, your own computer to copy a file, your own voice to sing a song. That’s what Kinsella objects to, and his objection has force. Token property restricts only the controller’s exclusive position on the ledger. It prevents nobody from creating their own tokens, copying any associated files, or using their own resources in any way whatsoever. Kinsella’s critique of IP — that it deploys force to prevent people from using their own property — has zero application to token property. Collapsing the two is a category error, and the entire anti-NFT argument from libertarian premises collapses once the distinction is made.

Three Counterexamples That End the Debate

Three existing property categories independently falsify the physicalist premise:

Radio spectrum. Not physically tangible (electromagnetic radiation). But rivalrous (same-frequency interference makes simultaneous use by different broadcasters impossible). Excludable (licensing, technical controls). Subject to conflicting claims (Coase documented this in his landmark 1959 paper). Transferable. Cumulative global auction revenues exceed $230 billion since 1994. Recognised as property by every legal system on earth.

Domain names. Not physically tangible (a protocol mapping). But rivalrous (unique DNS mapping — there can only be one google.com). Excludable (registrar controls). Subject to constant conflicting claims (WIPO reports over 60,000 UDRP disputes since inception). Transferable (individual sales exceeding $30 million — Voice.com for $30M in 2019, Insurance.com for $35.6M in 2010). Governed by compulsory dispute resolution (UDRP panels issue binding decisions whether respondents consent or not — which is, itself, a state-function for the domain-name domain).

Bitcoin. Not physically tangible (a ledger entry). But rivalrous (UTXO single-spend — the protocol makes double-spending computationally infeasible by design). Excludable (private key cryptography). Subject to conflicting claims (custody disputes, fork disputes, theft recovery cases). Transferable (global 24/7 markets with deep liquidity). Market capitalisation exceeding $1 trillion at multiple points since 2021. Classified as property by the U.S. Internal Revenue Service (Notice 2014-21, 2014), HM Revenue & Customs (Cryptoassets Manual, 2024), and the English High Court (AA v Persons Unknown [2019] EWHC 3556 (Comm)).

Each satisfies every criterion Kinsella assigns to property-eligible scarcity while being non-physical. The physicalist restriction isn’t a derivation from property theory. It’s an unsupported addition to it — and it’s refuted three times over.

Blockchain: The State-Function in Code

Here is the supreme irony of the entire debate. Blockchain technology solves the digital property problem precisely because it supplies — within its domain — the very features that Kinsella’s anti-state framework cannot provide in the physical world.

A blockchain provides finality: consensus mechanisms produce terminal states that cannot be reversed without expenditure exceeding the value of the attack. It provides compulsory jurisdiction: the protocol rules apply to all participants, and there is no mechanism to “veto” the protocol’s state-transition function while remaining within the network. You can’t refuse to accept that a confirmed transaction happened, the way a mining company can refuse to accept an arbitrator’s jurisdiction. It provides unitary publicity: one authoritative ledger within the consensus-dominant branch — no competing registries claiming different ownership of the same token.

I want to be precise about the limits, because overstating this claim would undermine it. Blockchain provides enforcement of token state transitions within a consensus-dominant branch. It does not provide enforcement of off-chain promises, identity verification, fraud remediation, or physical-world possession disputes. Forks occur — chain splits produce competing ledgers, and the selection of the dominant branch is a social governance process. Protocol upgrades are politically contested. Validator coordination happens off-chain. The novelty claim is confined to this: on-chain finality for token state transitions within the consensus-dominant branch.

But that is enough. Within its domain, blockchain is the state-function implemented in code. It provides finality, publicity, and a self-enforcing rule of recognition — precisely the institutional features that polycentric physical-world enforcement structurally cannot supply. Blockchain doesn’t replace the physical-world state. It is a state, for the specific domain of digital token ownership. And libertarians who celebrate Bitcoin while rejecting the concept of monopoly terminal authority are celebrating the very thing they claim to oppose — they just haven’t recognised it yet.

The Historical Record Agrees

Every historical example of “successful private law” confirms the impossibility result once you examine the details rather than the mythology.

The medieval lex mercatoria — merchant courts at European fairs — is the favourite example cited by proponents of private law. But it operated under three conditions that make it inapplicable to the general case. First, it served a closed, repeat-player community — the same merchants meeting at the same fairs season after season — enforcing compliance through reputational sanctions effective only among actors who needed ongoing market access. Against outsiders, transients, or wealthy actors with alternative supply chains, the sanctions were worthless. Second, merchant courts had effective exclusion power: being banned from the fair was devastating for a fair-dependent merchant, but irrelevant to a wealthy party who could source goods elsewhere. Third — and this is the detail proponents always omit — the system operated in the shadow of sovereign enforcement. Historians Berman (1983) and Milgrom, North, and Weingast (1990) document that merchant courts relied on the background threat of royal enforcement for cases exceeding their jurisdictional reach. The lex mercatoria was not a genuinely polycentric alternative to the state. It was a specialised niche court operating within a sovereign framework. Remove the sovereign shadow, and it collapses.

California Gold Rush mining districts (1848–1855) formed district associations, adopted claim-staking rules, and enforced them through community pressure and occasional vigilante justice. The system is often presented as proof that private ordering works. It did — briefly, among rough equals. When large corporate mining operations arrived in the 1850s with superior capital, small-claim miners were systematically dispossessed through procedural endurance (funding endless disputes until the small miner ran out of money), evidentiary gaming (hiring experts to reinterpret claim boundaries), and institutional capture (mining companies funded the very associations that set the rules). The system was replaced by state mining law (the General Mining Act of 1872) because polycentric enforcement could not protect the weak against the strong. The historical transition from private to public mining law is a direct confirmation of the impossibility theorem.

ICANN — the Internet Corporation for Assigned Names and Numbers — began in 1998 as voluntary, private, multi-stakeholder governance for domain names. Today it is a de facto monopoly on domain-name registry authority, exercising compulsory jurisdiction through the UDRP (Uniform Domain-Name Dispute-Resolution Policy). Registrants are bound by UDRP panels regardless of consent. There is one authoritative root zone file. ICANN provides finality, compulsory jurisdiction, and unitary publicity for the domain-name system. The transition from voluntary governance to compulsory monopoly jurisdiction — predicted by the models as the inevitable consequence of network externalities producing winner-take-most dynamics — happened in under a decade.

Every case either failed under asymmetric power or recreated monopoly functions to survive. There are no counterexamples in the historical record. The proponents of polycentric law keep citing examples that, on close inspection, prove the opposite of what they claim.

The Terminal Dilemma

Kinsella grounds property in scarcity and conflict avoidance. He rejects the state as monopoly coercion while asserting that property enforcement can be supplied by competing private agencies. He restricts property-eligible scarcity to physical rivalrousness while asserting that digital objects cannot be property.

Both claims fail under formal analysis.

Conflict avoidance for scarce resources requires enforceable finality against defectors, which polycentric orders cannot supply without consolidating into monopoly authority. Every repair mechanism — treaties, reputation, insurance, bonds, escrow, charters, auditors — either fails against determined defectors or reintroduces the monopoly function it was designed to avoid. The commitment-device extensions prove this formally for each model: there is no escape route that doesn’t lead back to the state.

The physicalist scarcity restriction is falsified by three independent counterexamples — spectrum, domain names, and Bitcoin — each satisfying every criterion Kinsella assigns to property-eligible scarcity while being non-physical. The domain partition demonstrates that institutionally rivalrous positions (Category II) are already treated as property throughout global commercial life. The restriction is an unsupported addition to property theory, contradicted by the entire structure of modern commerce.

Kinsella’s project therefore faces a terminal dilemma: it either fails to secure property for the weak, or it reconstructs a state-in-function to do so. And his anti-digital-property argument rests on a hidden physicalist premise that is contradicted by hundreds of billions of dollars of existing property rights that everyone — including libertarians — already accepts as genuine.

A property right that cannot compel compliance from the strong without requiring the victim to purchase equivalent coercive capacity is not a right. It is a priced service. And a theory that cannot accommodate the property categories governing hundreds of billions of dollars in global commerce is not a theory of property. It is a theory of a subset of property, mistaken for the whole.

The formal paper, “Enforceable Finality and the Impossibility of Polycentric Property: A Formal Proof with Applications to Digital Token Ownership,” is under submission to tpeer review. It contains the complete axiomatic framework, all twenty-three lemmas, three game-theoretic models with commitment-device extensions, the conditional impossibility theorem, a minimal-assumption-set proposition, comparative institutional analysis, a formal counterexample set with empirical anchoring, four historical analogues, and an argument dependency graph.

“It’s worse than corruption. It’s the market working exactly as designed.”